How To Know Total Annual Income

Once you have your estimated gross annual income you may want to figure out your net annual income. Your gross annual income divided by 12.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

One example is a 1200 weekly pay being multiplied by 52 to get an annual gross income of 62400.

How to know total annual income. Dont lie about your income but dont stress if you cant figure out an exact number. Your total annual income. To know your total income sum up your annual income under all the.

Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income. You can determine your annual net income after subtracting certain expenses from your gross income. You dont need to bust out a calculator and add up every paycheck from the past year.

If you add up all your earnings after deductions this is your net annual income. For example a credit card company may use your salary to decide what you can afford in order to determine your credit line. This is line 7b of the new Form 1040.

In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. How to calculate annual income. If youre in a new job you can check your pay stubs to look for your net income per pay period then use that figure to determine your annual salary.

To find your estimated annual income multiply your monthly income by 12 since there are twelve months in a year. The formula for the annual income is. Add up all taxes and total deductions and subtract them from your earnings to get your net annual income.

According to Measom a distinction must be made between being paid twice a month and every two weeks and confusing the two results in a wrong calculation. This will result in your annual salary. You get to Total Income by adding the components on lines 1 2b 3b 4b 4d 5b 6 and 7a.

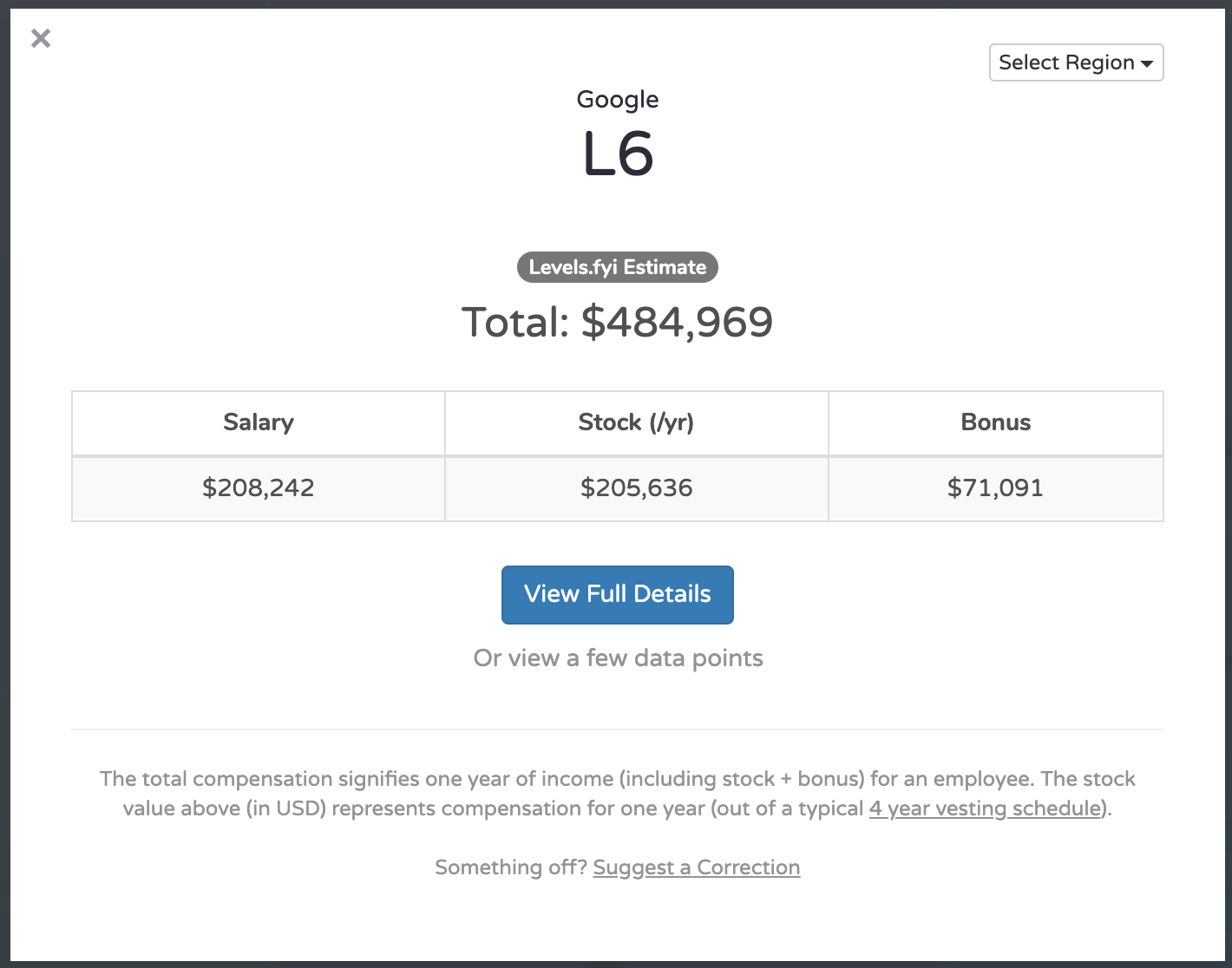

Annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator substitute your numbers into this formula. Next determine any additional bonuses or overtime This will be included in your annual income. Or so Congress thinks.

Whether youve applied for a credit card an apartment or a loan theres one number thats important to know. 35 lignes Ans. It is now simpler and sleeker.

If youre still confused about how to find annual income have a look at the examples. If your gross pay is 2000 and you are paid biweekly you would multiply 2000 by 26 since biweekly paid employees receive 26 paychecks per year. For example if you make 2000 per month from rental income and 500 per month from self-employment income add both together for a sum of 2500 per month.

How often a person gets paid and the amount determines annual gross income. Multiply this amount by the number of paychecks you receive each year to calculate your total annual salary. After finding out your total taxable income you have to subtract what you owe in taxes.

The Annual Salary Calculator will translate your hourly pay into its yearly monthly biweekly weekly and daily equivalents including any weekly time-and-a-half overtime wages. First determine your hourly pay rate and working time Your working time will include days per week hours per day and. The first option is to subtract any deductions from your gross annual income.

But if you don. Form 1040 got a makeover in 2018 when the Tax Cuts and Jobs Act was passed. All money received from.

Find your total gross earnings before deductions on your pay stub. Your total annual income is how much you earn in a year and is used as a benchmark in many financial situations. Multiply your gross pay by the number of paychecks you will receive each year.

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage. Determine your annual salary. Plus since you can adjust the weekly hours and number of work weeks per year the calculator will work for.

Using the earlier example if your gross income is 55000 with 5000 in deductions and another 3000 for retirement your taxable income is 47000. On line 7b of Form 1040. To do this there are two methods.

Calculate your annual. The other option is to take the deductions out from your earnings before you calculate your gross annual income. Deductions include things like taxes or child support.

Your annual net income can also be found listed at the bottom of your paycheck.

How Do Operating Income And Revenue Differ

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Sales Revenue Formula Calculate Grow Total Revenue

Amazon Annual Net Income 2020 Statista

Annual Income Learn How To Calculate Total Annual Income

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Annual Income Learn How To Calculate Total Annual Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Revenue Run Rate Formula How To Calculate

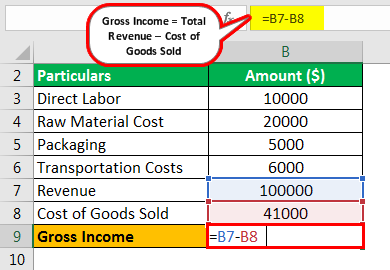

Gross Income Formula Step By Step Calculations

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Taxable Income Formula Examples How To Calculate Taxable Income

Gross Income Formula Step By Step Calculations

Post a Comment for "How To Know Total Annual Income"