13th Month Pay Non Taxable Philippines

Only the portion if any above the said amount is subject to regular income tax. The 13th month pay is equivalent to one twelfth 112 of an employees basic annual salary.

13th Month Pay An Employer S Guide To Monetary Benefits

The 13th month pay is equivalent to one twelfth 112 of an employees basic annual salary.

13th month pay non taxable philippines. It was legally introduced in the Philippines in 1975 where it is still enshrined in employment law. Is 13th month pay obligatory. MANILA Philippines The amount of tax-free 13th month pay has been raised to P90000 while the excise tax tiers on sugar-sweetened beverages have been.

Under Section 32B Chapter VI of R. Before RA 10653 was signed into law in 2015 only bonuses not exceeding P30000 were tax-exempt. 8424 the benefit must not exceed P30000.

Thirteenth month pay is a form of compensation in addition to an employees annual 12 month salary. Under a law passed by the previous Congress and signed by then president Benigno Aquino III annual bonuses of up to P82000 are exempt from income tax. Under Presidential Decree No.

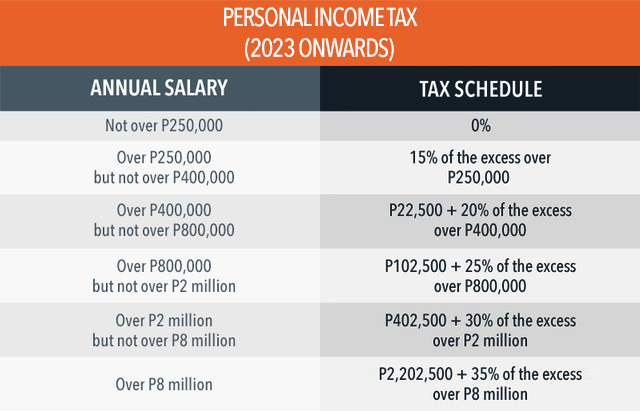

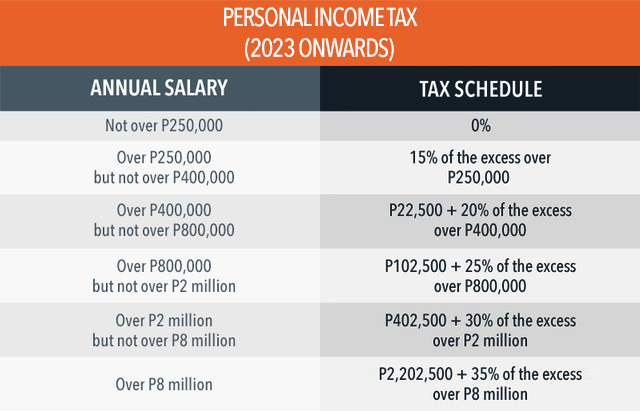

It is a mandatory benefit provided to employees pursuant to Presidential Decree No. Under Philippine law 13 th month pay below the PHP30000 threshold is tax-exempt. Under the TRAIN Law 1 the 13th-month pay and other benefits received by an employee not exceeding Php 90000 are excluded from the computation of gross income and thus exempt from taxation.

Hence if you receive a 13th-month pay amounting to more than Php 90000 the excess of said amount is included in your gross income and shall be taxable. Gross Pay 250000 13thmobonus 72000. MANILA - Lawmakers agreed to raise the cap on tax exempted 13th month pay to P90000 a Senate leader said Thursday.

851 employers from the private sector in the Philippines are required to pay their rank-and-file employees a Thirteenth 13th Month Pay not later than December 24 every year. 851 employers from the private sector in the Philippines are required to pay their rank-and-file employees a Thirteenth 13th Month Pay not later than December 24 every year. All rank-and-file employees who have worked for at least one month in a company are entitled to a 13th month regardless of the.

13th Month Pay in the Philippines. The amendment was introduced during a bicameral conference committee meeting to reconcile the Senate and House of Representatives versions of tax reform before President Rodrigo Duterte can sign it into law. The 13 th month pay is exempt from tax up to a limit of PHP 90000 US1778 and is mandatory while the Christmas bonus is at the discretion of the employer.

13th month pay is an additional compensation given to employees in the Philippines typically at the end of a year. Based on the primer if your 13th month pay is Php 9000000 and below it is not subject for tax deduction. It is also known as 13th month salary or 13th salary and in some countries a 14th month salary is also common.

However there is a limit as to the maximum amount of the 13th month pay which is exempt from tax. No the payment of 13th month pay is mandatory specifically provided under Presidential Decree PD No. Employers can pay the 13th Month Pay benefit in installments but remember the full amount must be paid no.

13th Month Pay in the Philippines. Any amount in excess thereof may be subjected to tax. Under Presidential Decree No.

There are two key aspects here for non-Filipinos hiring remote to remember. 82K is the maximum amount that is non taxable meaning if you receive a total 13th mo bonus of 72k the whole amount received will not be included in your taxable income. From the foregoing it can be said that the 13th month pay of employees is not taxable.

It is the current exemption cap after it was raised from Php 8200000. Time of Payment of 13th Month Pay. In case of non-payment of 13th month pay covered employees could complain at the Department of Labor and Employment DOLE or the National Labor Relations Commission NLRC.

The 13th month pay shall not be less than 112 of the total basic salary earned by an employee within a calendar year. Employers in the Philippines should understand the obligations around the 13 th month pay and Christmas bonuses. We let them know that the 13th month pay is tax-free up to PHP 90000 and any amounts above that are taxable and the tax would be deducted from the final payment.

It is the current exemption cap after it was raised from Php 8200000. The tax-free amount of PHP 90000 also includes other equivalent benefits like commissions and bonuses that have to factor into the calculation. What is 13th month pay in the Philippines.

Employers in the Philippines are required to pay the 13th Month Pay to all relevant employees on or before 24 December each year. Under current law or Republic Act 10653 the 13th month pay and other benefits including productivity incentives and Christmas bonuses are exempted from tax if they do not exceed P82000.

13th Month Pay An Employer S Guide To Monetary Benefits

How To Compute For 13th Month Pay In The Philippines Coins Ph

Expats Guide To 13th Month Pay And Christmas Bonus Philippine Primer

Dole Guidelines For 13th Month Pay In Private Sectors

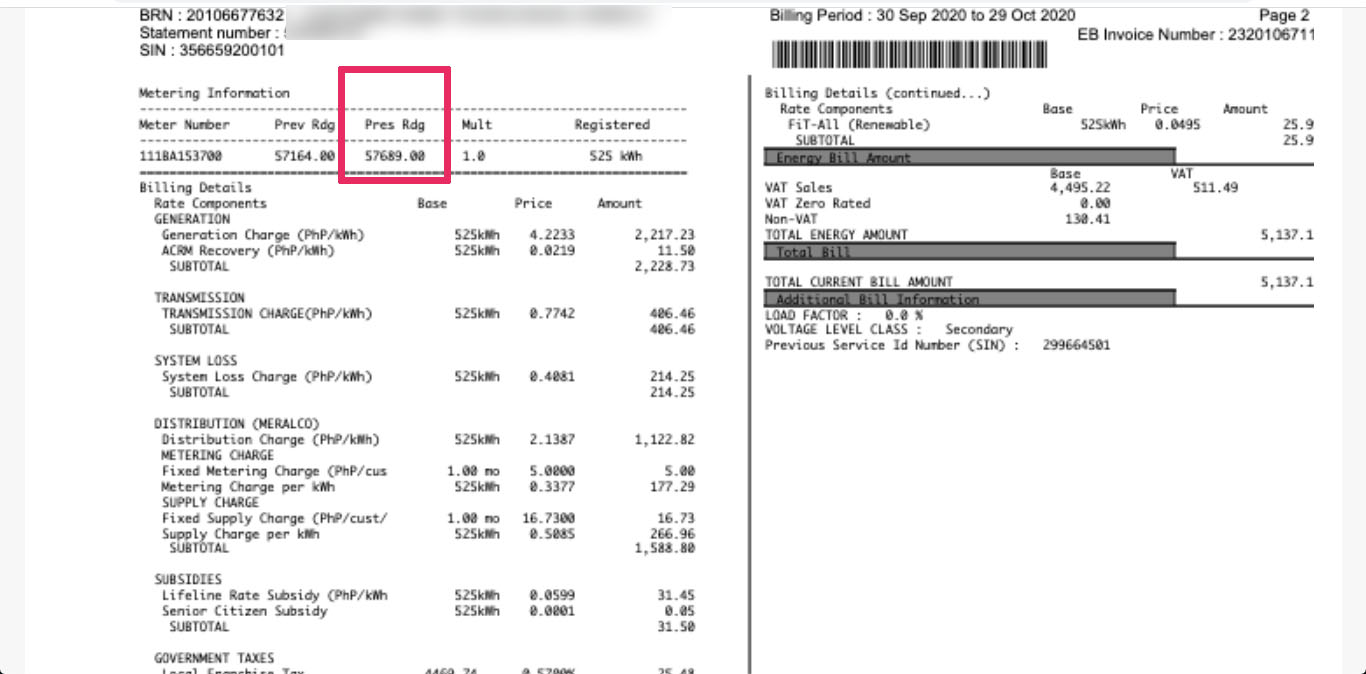

How To Compute Your 13th Month Pay Income Tax Meralco Bill Other Bayarin Pep Ph

13th Month Pay An Employer S Guide To Monetary Benefits

How To Compute Your 13th Month Pay 2020 Jobs360

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

10 Things You Should Know About 13th Month

Everything You Need To Know About 13th Month Pay Sunstar

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

Dole Guidelines For 13th Month Pay In Private Sectors

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

Tax Calculator Compute Your New Income Tax

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

13th Month Pay And 14th Month Pay Salary Tax Exemption

A 13th Month Pay Guide For Employees

How To Compute 13th Month Pay 13th Month Pay Months Computer

Post a Comment for "13th Month Pay Non Taxable Philippines"