Monthly Salary Calculator After Tax Uk

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system.

Net Salary Greece Salary Calculator National Insurance Salary

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

Monthly salary calculator after tax uk. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your.

The salary calculator will work out your take-home pay Tax Free Allowance Taxable Income National Insurance and Income Tax. Usually the starting salary is around 20000-21000 for an entry level graduate or junior teacher However this salary scale can be around 37000 45000 for a senior teacher. Social Security and Medicare.

If your income is 984140 then after tax you will be left with a net monthly take-home salary of 44395. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. How to use the Take-Home Calculator.

Why not find your dream salary too. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. For more accurate information on teacher salaries please simple make a job search. Low income earners salary less than 10084 EUR do not pay income tax but after this amount the tax grows until 45 for individuals who earn more than 158222 EUR.

Your total net yearly amount after tax and NI will be 532734 and your hourly rate will be 47315 if youre working 40 hours a week as a full time employee. As the job posts in the UK. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

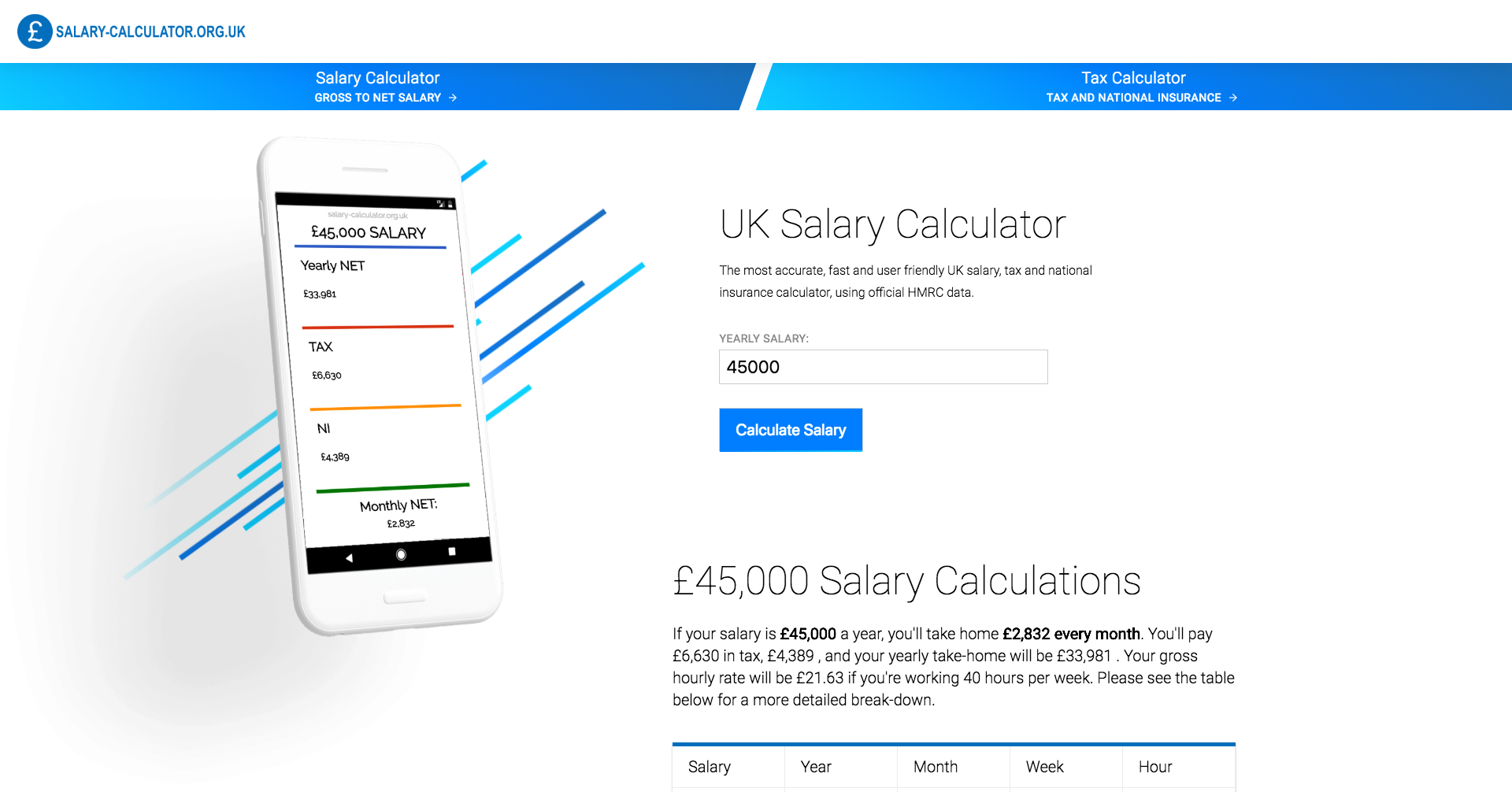

To use the tax calculator enter your annual salary or the one you would like in the salary box above. 45000 Salary Calculations example If your salary is 45000 a year youll take home 2853 every month. Find out your take-home pay - MSE.

Average teacher salary in the UK is 30402. Hourly rates weekly pay and bonuses are also catered for. The results are broken down into yearly monthly weekly daily and hourly wages.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. France does not withhold income taxes from the monthly income this means that individuals have to complete an. 984140 YEARLY INCOME IS 44395 MONTHLY NET SALARY.

The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. The calculator assumes the bonus is a one-off amount within the tax year you select. Estimate your Income Tax for the current year.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. The latest budget information from April 2021 is used to show you exactly what you need to know. This is calculated on the basis of different levels of teacher jobs in the UK.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Enter the number of hours and the rate at which. The amount of tax that you pay is not based on your earnings as an individual but on your earnings as a household.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions. The results are broken down into yearly monthly weekly daily and hourly wages.

UK Tax Salary Calculator. Enter what you earn annually before any taxes and deductions have been taken out. Find out the benefit of that overtime.

This calculator is intended only as a guide and uses normal UK tax and NI information to calculate the net salary of an employed person. After tax - UK Salary Tax Calculator 40000 After Tax If your salary is 40000 then after tax and national insurance you will be left with 30840. Your gross hourly rate will be 2163 if youre working 40 hours per week.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. All you need to do is enter your regular salary details and then enter the amount of the bonus. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you have other deductions such as student loans you can set those by using the more options button.

Uk Take Home Salary Calculator And Income Tax Slabs Income Tax Salary Calculator Income

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Income

Paycheck Calculator Take Home Pay Calculator

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

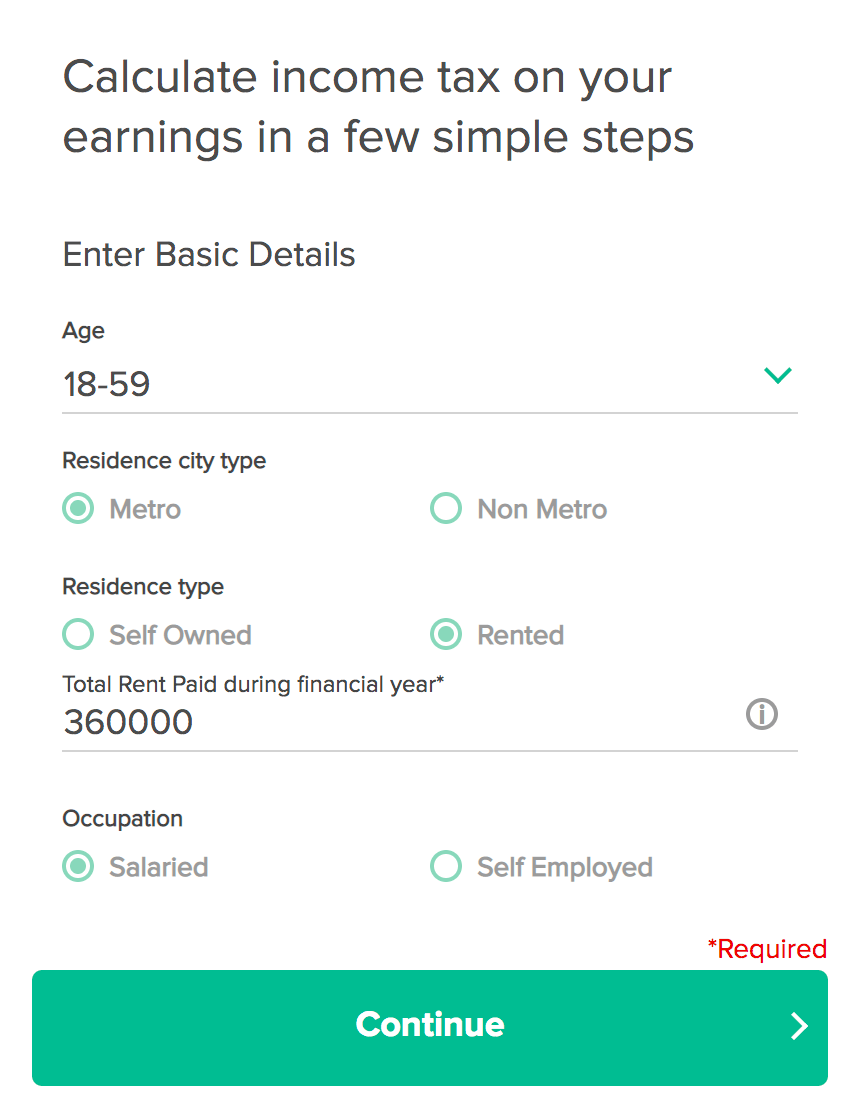

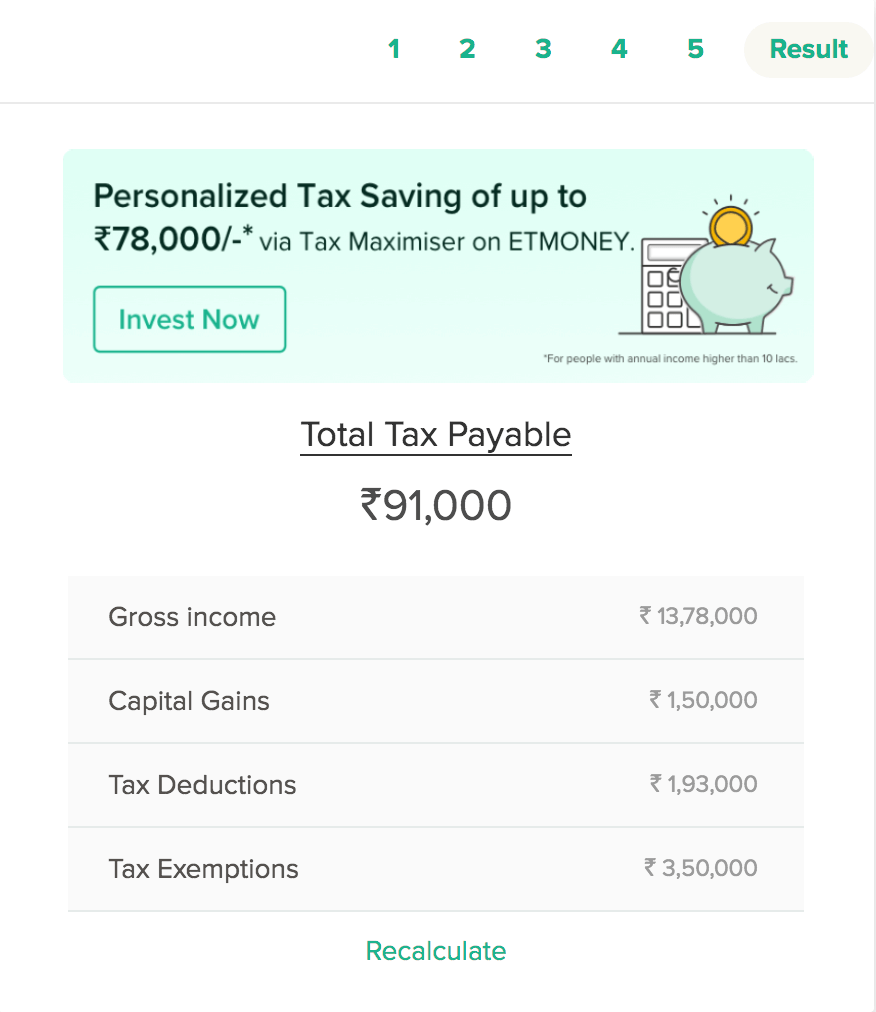

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Excel Payroll Calculator Template Software Download Payroll Template Excel Spreadsheets Templates Payroll

Mortgage Life Insurance In Rodd Mortgage Life Insurance Companies Rodd Https T Co Pvegjyajmw Mort Life Insurance Policy Life Insurance Health Insurance

25 000 After Tax Salary Calculator Uk

The Future Of The Online Payslips In Uk Released By The Cipp Payroll Checks National Insurance Number Templates

Take Home Pay Calculator Find Your Pay With Dns Accountants Http Www Dnsassociates Co Uk Take Home Pay Calculator F Umbrella Insurance Accounting Umbrella

Self Employed Tax Calculator Business Tax Self Employment Success Business

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

34 000 After Tax 2021 Income Tax Uk

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Nannyplus Tax Table 2017 18 Nanny Nanny Agencies North West

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Post a Comment for "Monthly Salary Calculator After Tax Uk"