Gross Pay Meaning Example

For instance if an employee has a gross salary of Rs. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay.

Pay Slip Form Or Salary Slip Is One Of The Most Significant Documents For The Accounts Departme Invoice Template Word Payroll Template Company Profile Template

To compute the gross pay of employees with an annual rate divide the total amount of yearly pay by the number of pay periods within a year.

Gross pay meaning example. English words and its meaning improve word power and learn english easily. This amount is equal to your base salary plus all benefits and allowances such as special allowances overtime pay medical insurance travel allowance and housing allowance. Common allowances on your payslip.

Gross pay often called gross wages is the total compensation earned by each employee. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes and related.

Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. 40000 and a basic salary is Rs18000 he or she will get Rs18000 as fixed salary in addition to other allowances such as House rent allowance conveyance communication dearness allowance city allowance or any other special allowance. If a company advertises a job for 24000 per year this would be the annual Gross pay.

They are the total wages that an employer pays to the employee without deducting any charges or. Gross salary refers to the full payment an employee receives before tax deductions and mandatory contributions are removed. Other pay or benefits should be added.

It may include salary annual rate wages hourly rate bonuses or reimbursements if any vacation pay holiday pay or commissions. Hourly rate x hours you worked Gross pay. Good-old-europe-networkeu Le salaire de référence qui est actuellement la rémunération brute-nette cest-à-dire la rémunération brute diminuée des cotisations salariales de toutes les années depuis 1988 se rapproche de la durée de la vie active.

Traductions en contexte de Gross Pay en anglais-français avec Reverso Context. For example if the employees annual pay is 12000 and there are 24 pay periods in a year their gross pay per period is 500. It is different from Taxable pay.

Gross pay is the employees income before any pension or salary sacrifice deduction. If you work on an hourly basis then your gross pay may vary from week to week. 50 000 and basic salary of Rs.

It is the gross monthly or annual sum earned by the employee. For example if the revenue earned by an individual for rendering consultancy services amounts to 300000 the figure represents the gross income earned by that individual. Gross salary is determined by the employer when the job is offered.

Gross pay can increase if you earn any additional money during a pay period. The exempt or salaried employee is paid gross pay based on the amount of her annual salary divided by the number of pay periods in a year usually 26. Gross wage less employees contribution in all years since 1988 moving towards the full lifetime.

The earnings base is currently net-gross pay ie. For example if an employer offers you a sales position with a base salary of 50000 plus a bonus of 2500 for every 25000 in sales the total you earn would be your gross pay. Notice I didnt say it was the total amount paid to each employee.

For example a salaried employee who makes 40000 per year is paid by dividing that 40000 by the number of pay periods in a year. Not all the bonuses are included in the calculation of Gross Pay and reported as income to the LES. An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement.

What Does Gross Salary Mean. We will use an annual Retail Sales Worker salary for our examples. Gross salary however is the amount paid before tax or other deductions and includes overtime pay and bonuses.

Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax For Example. 20 000 then heshe will get a Rs. Gross wages are the total amount of remuneration paid to employees either hourly or monthly before any deductions like taxes which include social security and Medicare life insurance pension contributions bonuses etc are made.

Gross pay is the amount that you are actually paid by a company. For example you might receive payments such as. An employee has a gross salary of Rs.

Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay. 20000 as a fixed salary. Gross pay is almost exclusively higher than Net Pay Net Pay is the amount you receive after all deductions have been made.

You can calculate your gross pay with this formula.

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Income Accounting And Finance Business Money Accounting Basics

Statement Of Retained Earnings Reveals Distribution Of Earnings Income Statement Company Financials Financial Statement

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

Income And Expenditure Account Definition Explanation Format And Example Accounting For Management Accounting Income Fund Accounting

Chart Of Accounts Meaning Importance And More Chart Of Accounts Accounting Bookkeeping Business

Gross Vs Net Differences Between Net Vs Gross You Must Know 7esl English Words Learn English Meant To Be

Gross Income Definition Formula Examples

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

English Collocations With Pay English Collocations Learn English English Tips

Learn How To Read A Balance Sheet To Understand Your Business S Financial Position On A Specific Da Balance Sheet Financial Statement Profit And Loss Statement

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

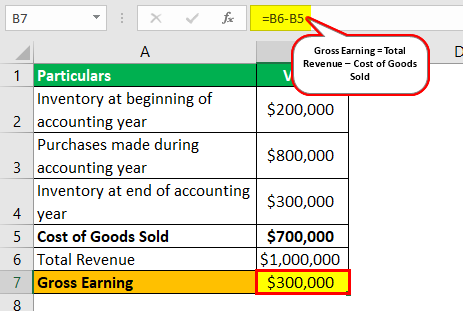

Gross Earning Meaning How To Calculate Gross Earning

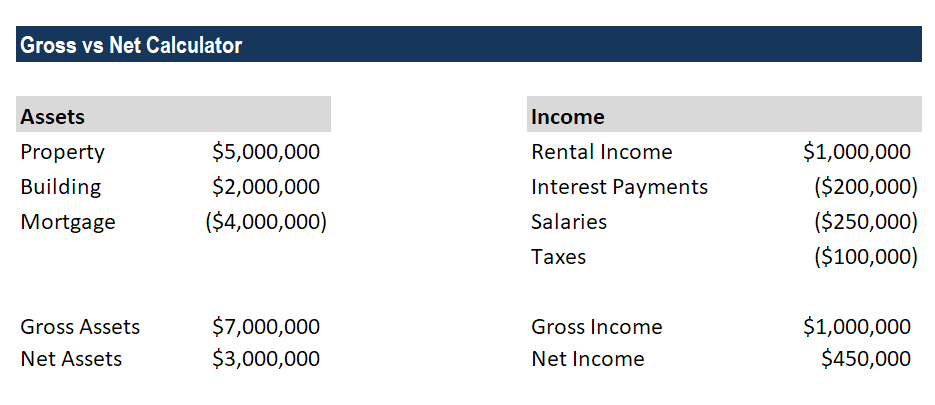

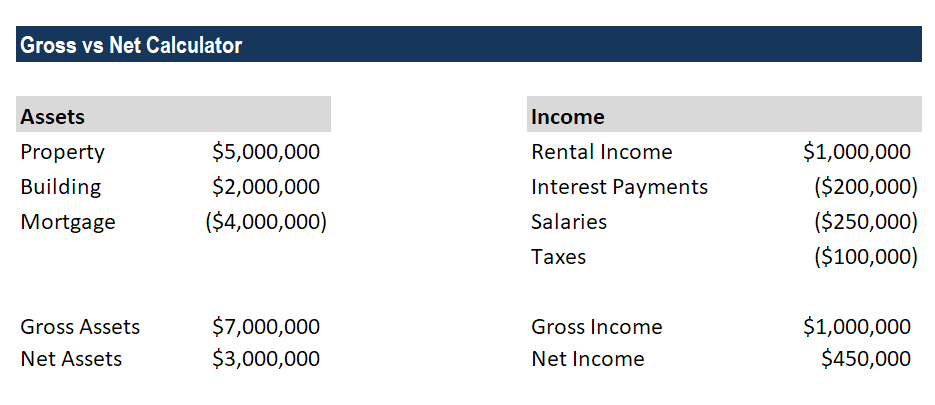

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Post a Comment for "Gross Pay Meaning Example"