What's Total Annual Income

Aggregate income before deductions under chapter VIA is known as Gross Total Income. Annual Salary PDHWBO.

Federal Government defines a fiscal year as starting on October 1st and ending on September 30th of the.

What's total annual income. Or so Congress thinks. So you first calculate the GTI. This is often referred to as unearned income.

How Much Annual Income Do You Need to Be Approved for a Credit Card. Depending on the data that is required to determine your annual income you may base your income on either a calendar year or a fiscal year. The definition of year can change.

It is now simpler and sleeker. If youre still confused about how to find annual income have a look at the examples. H is the number of hours worked per day.

Form 1040 got a makeover in 2018 when the Tax Cuts and Jobs Act was passed. Annual income is the total amount of money you earn during a year. Annual income is the amount of income you earn in one fiscal year.

Total annual income is referred to as gross income on tax returns and is calculated before deductions and adjustments that result in the adjusted gross income. Where BO is bonuses or overtime. It will also include profit or loss carried forward from past years and any income after clubbing provisions.

W is the number of weeks worked per year. 35 lignes Ans. You get to Total Income by adding the components on lines 1 2b 3b 4b 4d 5b 6 and 7a.

Annual income means your income from all sources it is same as Gross Total Income. A calendar year is January 1st to December 31st of the same year. Annual income is the total income that you earn over one year.

What is total income. Annual income is the total amount of money you make each year before deductions are taken out of your pay. D is the number of days worked per week.

Annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator substitute your numbers into this formula. For example if youre paid a 75000 yearly salary this is your annual income even though you dont actually take home 75000 after deductions. If you are self-employed youd use the income that you allocated to the year under cash or accrual accounting basis.

240 multiplied by 52 weeks in a year is 12480. You can either go by a calendar year which is January through December or a fiscal year which the federal government defines as October through September. Its important to know the difference between the.

You may hear it referred to in two different ways. The total income TI is derived after subtracting the various deductions under Section 80 from the GTI. Annual income is defined as the annual salary before taxes an individual earns on a yearly basis.

Multiply your answer by 52 weeks in a year. On line 7b of Form 1040. If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year.

In some cases it may also refer to any payments you may receive as well such as alimony payments Social Security benefits child support and more. The formula for the annual income is. Gross annual income is your earnings before tax while net annual income is the amount youre left with after.

While AGI is the amount of money you receive in a fiscal year your net annual income is the amount left after taking deductions into account. For example someone with a gross annual income of 100000 and a tax rate of 25 would have a net annual income of 75000. This is line 7b of the new Form 1040.

The gross total income GTI is the total income you earn by adding all heads of income. Your total annual income is how much income you earn each year from your job. Annual gross income or AGI is sometimes confused with net annual income.

In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. Q - What is the gross total income. 65 lignes When measured in current dollars the United States total personal income increased 48159 from 400B in 1959 to 19680B in 2020.

But will not include any deductions from section 80C to 80U. For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50. Income from salary property other sources business or profession and capital gains earned in a financial year are all added to arrive at the GTI.

For example if you earn 800 per hour and work 30 hours per week you have 240. Gross annual income and net annual income. Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips earned.

When measured in constant 2012 dollars to adjust for inflation it advanced 6168 from 2470B in 1959 to 17705B in 2020. Where P is your hourly pay rate. Q - Is total income before or after tax.

You have your annual or yearly salary.

Annual Income Learn How To Calculate Total Annual Income

Gross Annual Income Calculator

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is The Average American Income In 2021 Policyadvice

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Definition Formula Examples

Annual Income Learn How To Calculate Total Annual Income

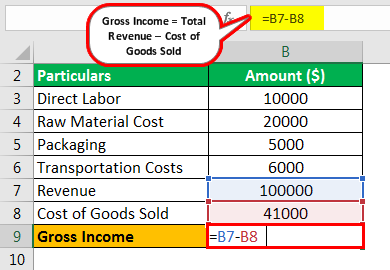

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Taxable Income Formula Examples How To Calculate Taxable Income

Average Salary In France 2021 The Complete Guide

Gross Income Formula Step By Step Calculations

What Income Level Is Considered Rich Financial Samurai

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

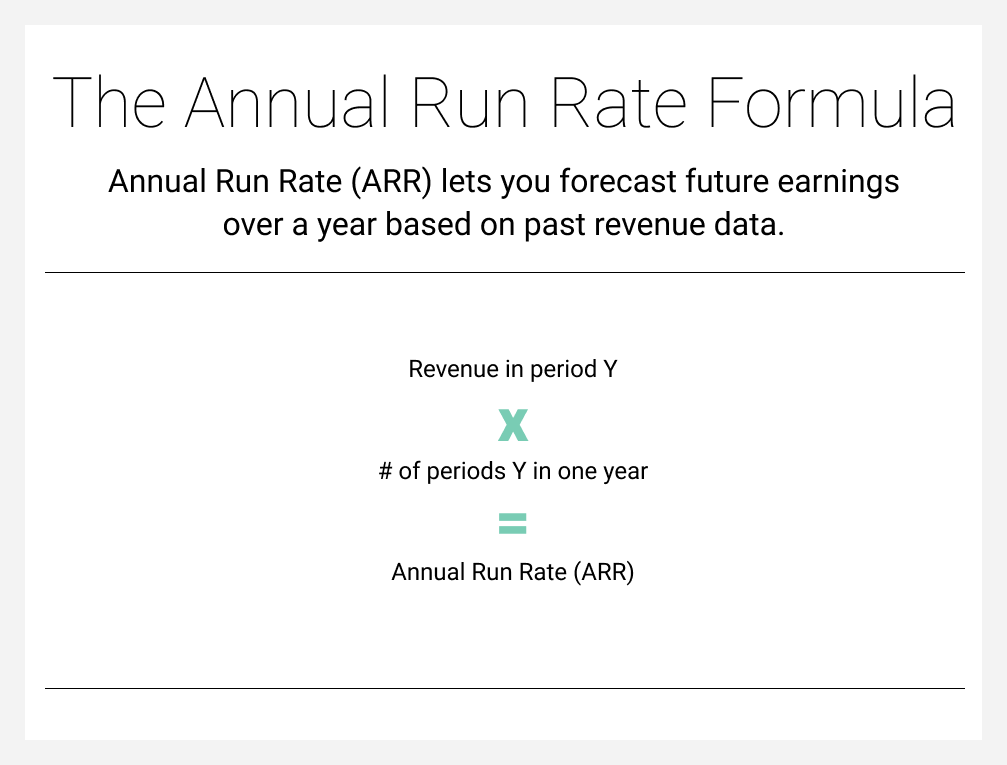

What Is Revenue Run Rate Formula How To Calculate

Average Salary In Paris 2021 The Complete Guide

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "What's Total Annual Income"