Monthly Salary Calculator India After Tax

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400. To calculate the self-assessment tax first calculate the net taxable income after giving into effect every deduction and exemption.

How You Can E Verify Itr V Or E Verify Income Tax Return Income Tax Return Income Tax Tax Refund

ESI is calculated on 075 of Gross Pay Basic and LOP dependent allowances or 21000 whichever is lower Rules for calculating payroll taxes FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction.

Monthly salary calculator india after tax. Find out your take home salary after tax for 202021. Youll then get a breakdown of your total tax liability and take-home pay. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Find out how much of your salary youll take home after income tax national insurance pension contributions and student loans. Take Home Salary Calculator India has been updated for the financial year 2020-2021 Take home salary calculator is also referred in india as in hand salary calculater. Dont know what your salary is just the hourly rate.

Your Total Income After Tax. Self-assessment tax will be total tax payable minus taxes already paid ie. Salary calculations include gross annual income tax deductible elements such as NIS NHT education tax and include age related tax allowances.

This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. Let The Hourly Wage Calculator do all the sums for you - after the tax calculations see the annual pay and the monthly. You will pay 5500 tax at the basic tax rate of 20.

Income tax 96. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. ICalculator also provides historical Indian earning figures so individual employees and employers can review how much tax has been paid in previous assessment years or you can use the salary calculator 202122 to see home much your take home salary.

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. The Salary Site Salary Calculator - India. Salary Calculator India.

This will give you 1042 per month of tax free earnings. Select the assessment year for which you want to calculate your income tax. The Hourly Wage Calculator.

Click on the Income field. The excel sheet calculates exact monthly salary. Discover what a difference a few hours overtime will make.

Youll pay no tax on the first 12500 that youre earning. It is calculated according to this formula. That means that your net pay will be 40512 per year or 3376 per month.

27500 of your earnings qualify to be taxed at 20. If you have HELPHECS debt you can calculate debt repayments. TDS TCS advance tax tax relief under section 87A9090A91 tax credit AMT MAT.

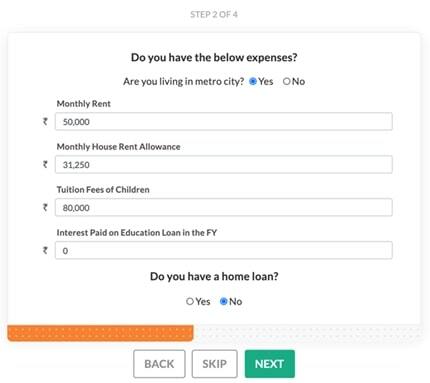

Enter the figures required in the fields under Income. Our Take Home Salary Calculator India 2020-21 tool helps you quickly calculate your estimated monthly take home salary from your CTC. It now also provides option to calculate your take home salary choosing either Old or New Tax Slabs to calculate your estimated tax liability.

Your take-home income could. You will pay a total of 5500 in tax per year or 458 per month. You can also refer to Scripboxs Income Tax Calculator to calculate the total tax.

Your total earnings before any taxes have been deducted. Subtract your total deductions to your monthly salary the result will be your taxable income. All you need is to enter the year CTC and monthly basic pay and the calculator will default all the parameters like EPF Gratuity Standard deduction HRA and Professional Tax before it calculates in hand salary.

Download Now FREE Tested verified on HP KONE HCL CSC iNautix and Flextronics Payslips best suits IT professionals in India You can download the excel sheet on successful payment. Your average tax rate is 221 and your marginal tax rate is 349. This is your yearly personal allowance.

Let The Take-Home Calculator tell you what its worth on a monthly weekly or daily basis - our tax calculator also considers NI student loan and pension contributions. Select your gender and if you are a senior citizen or super-senior citizen. Now calculate the total tax payable on such net taxable income.

The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD. Net salary 225000. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

And you can figure out are you eligible for and how much of Low Income Tax. It is designed to show clear. Last drawn salary basic salary plus dearness allowance X number of completed years of service X 1526.

Monthly salary 1600. Base on our sample computation if you are earning 25000month your taxable income would be 23400.

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Download Salary Arrears Calculator Excel Template Exceldatapro In 2021 Excel Templates Excel Salary

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Download Salary Breakup Report Excel Template Exceldatapro Payroll Template Breakup Excel Shortcuts

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Budget Spreadsheet Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

The Times Group Income Tax Return Income Tax Tax Return

Our Yellowpagesca Smart Tip Of The Day What New Investors Must Know What S The Dividend Tax Credit Business Loans Personal Loans Expense Management

Income Tax Calculator Calculate Your Income Tax Online In India

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Online Payroll Management System Software Hr Payroll Software Payroll Software Payroll System

Salary Formula Calculate Salary Calculator Excel Template

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Salary Calculator 2020 21 Take Home Salary Calculator India

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Salary Calculator 2020 21 Take Home Salary Calculator India

Salary Formula Calculate Salary Calculator Excel Template

Post a Comment for "Monthly Salary Calculator India After Tax"