The Total Annual Rental Income Possible From A Property If It Were Completely Leased

For example if you pay insurance on your rental property it is an expense you pay to earn income from the property. Given the following owners income and expense estimates for an apartment property formulate a reconstructed operating statement.

Rental Income Expense Worksheet Rental Property Management Rental Income Real Estate Investing Rental Property

The Total Annual Rental Income Possible From A Property If It Were Completely Leased.

The total annual rental income possible from a property if it were completely leased. Copies of the current lease agreements may be substituted if the borrower can document a qualifying exception. Types of rental income. But if the taxpayer keeps part or all the deposit during any year because the tenant doesnt live up to the terms of the lease then the taxpayer includes the amount kept as rental income.

Total RoC Return on Cash. OIRR or NPV. If you own a rental property that you receive an income from you can claim any expense associated with earning that income.

De très nombreux exemples de phrases traduites contenant annual rental income Dictionnaire français-anglais et moteur de recherche de traductions françaises. I want to make sure I put everything in the right place. If you own a property jointly with others youre each eligible for the 1000 allowance against your share of the gross rental income.

Owners Income Statement Rental income last year 60600 Less. The real estate cash flow model uses discounted cash flow DCF analysis to express an investments expected performance in terms of. Payments for canceling a lease.

Rental income generally doesnt include a security deposit if the taxpayer plans to return it to their tenant at the end of the lease. Choose NOI Assessed Value Insurable Value GRM Operating Expenses Appreciation Potential Gross Income Cap Rate CAM Loan Value The Cost. When the borrower owns property other than the subject property that is rented the lender must document the monthly gross and net rental income with the borrowers most recent signed federal income tax return that includes Schedule 1 and Schedule E.

200 Sum of rental properties is added to the borrowers DEBTS. Rental property expenses are deductions from your taxable income of expenses relating to the owning and operating a rental property. Using the examples above you would determine the net rental income or loss for each property and sum up the total as follows.

The building consists of 10 units that could rent for 550 per month each. If your annual gross property income is 1000 or less. 200 Rental Income Property 1.

Whatever you earn from various sources in a year makes up your annual income. The property is surrounded by a security fence that cost 4000 to install four years ago a. You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of renting out the property.

The Expenses Necessary To Keep A Property Operating Including Property Taxes Insurance Premiums And Common Area Maintenance. Expenses Power 2200 Heat 1700 Janitor 4600 Water 3700 Maintenance 4800. And there are lots of them.

300 Rental Income Property 2. If you did not own the property. Values of rents when they are received O Payments to the investor D Question 2 10 pts Which of the following are not included in.

I need help with building the income statement. Contact HMRC if your income from property rental is between 1000 and 2500 a year. The total annual rental income possible from a property if it were completely leased.

Shop being a building rental income will be charged to tax. The expenses necessary to keep a property operating including property taxes insurance premiums and common area maintenance. 800 Rental Loss Property 3.

To tax the rental income under the head Income from house property the rented property should be building or land appurtenant thereto. Annual expenses are 3000 for upkeep of the property and 1000 for property taxes. Expenses paid by the tenant.

The monthly income from a piece of commercial property is 1200. If i 12 per year the MARR is an acceptable interest rate how much could you afford to pay now for this property if it is estimated to have a. 2500 to 9999 after allowable expenses.

For example you sign a 10-year lease to rent your property. 100 Rental Income Property 4. Compares Total Returns to the total cash invested into the property.

Or said a different way my Total Returns across these 16 properties were equal to 167 of their value at the start of the year 459 of the amount of cash I have invested in the properties and 347 of my current equity in the properties. You must report it on a Self Assessment tax return if its. Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use.

Rental income from a shop Rental income from a property being building or land appurtenant thereto of which the taxpayer is the owner is charged to tax under the head Income from house property. Hotel 9 Income Statement 2015 2014 2013 Administrative and General 21511 28772 39164 Amortization 11190 8604 9591 Casino Labor Costs. In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease.

For instance if you have a property in some other state and you are receiving rental on it then apart from your salary if you are employed or profit if you own a business that rental income will be considered as your annual income. Choose NOI assessed value insurable value GRM operating expenses appreciation potential gross income cap rate CAM loan value The cost associated with maintaining the common.

3 Ways To Work Out A Rental Yield Wikihow

5 Great Things To Know About Rental Income And Taxes 1 800accountant

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

How To Save Tax On Rental Income Deductions Calculations Procedure

Real Estate Landlord Questionnaire Landlord Form Client Etsy Being A Landlord Real Estate Marketing Strategy Introduction Letter

Rental Property Management Template Long Term Rentals Rental Etsy In 2021 Rental Property Management Spreadsheet Template Property Management

Security Deposit Accounting Statement Ez Landlord Forms Being A Landlord Accounting Security

How To Calculate Property Value Based On Rental Income Mynd Management

5 Free Rental Property Expenses Spreadsheets Excel Tmp Rental Property Management Rental Property Being A Landlord

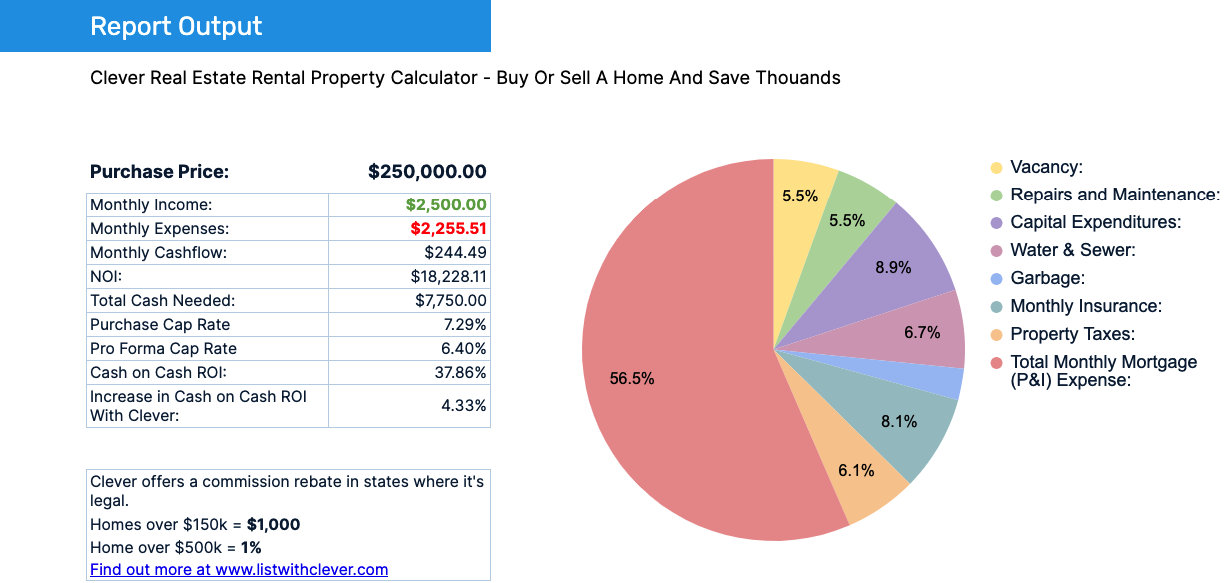

Rental Property Calculator Most Accurate Forecast Clever Real Estate

Tenant Payment Record Rental Payment Record Template 25 Etsy In 2021 Rental Income Being A Landlord Spreadsheet

25 Property Tracking Expense And Rental Income Tracking Etsy Being A Landlord Rental Property Management Rental Income

How To Save Tax On Rental Income In India Tax Deductions On Rent

3 Ways To Work Out A Rental Yield Wikihow

Rental Income Property Analysis Excel Spreadsheet In 2021 Statement Template Cash Flow Statement Rental Property Investment

How To Calculate Rental Income The Right Way Smartmove

Rental Income And Expense Worksheet Propertymanagement Com

Post a Comment for "The Total Annual Rental Income Possible From A Property If It Were Completely Leased"