Monthly Paycheck Calculator Ontario

If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 24. Enter the number of hours worked a week.

Paycheck Calculator Take Home Pay Calculator

You can calculate your Weekly take home pay based of your Weekly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

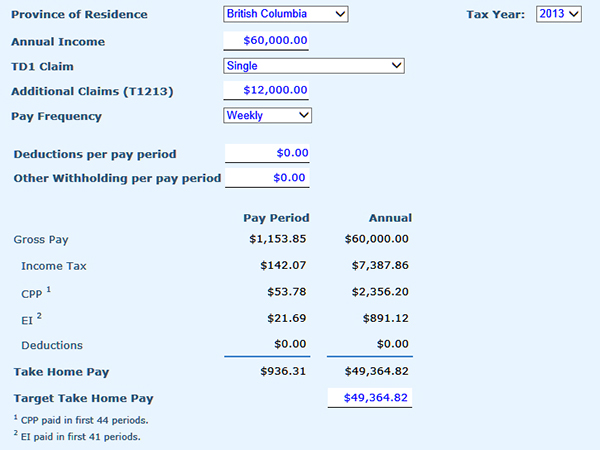

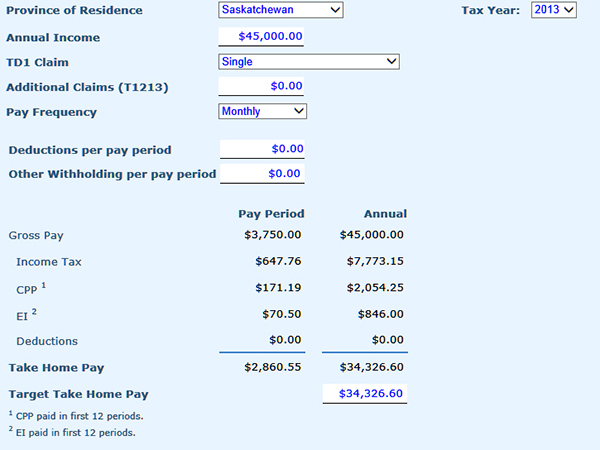

Monthly paycheck calculator ontario. Enter your pay rate. It will confirm the deductions you include on your official statement of earnings. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

We then indexed the paycheck. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. Where 151978 NI 216511 BPAF 13808 - NI - 151978 1387 64533 Where NI 216511 BPAF 12421.

Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review. The reliability of the calculations produced depends on the accuracy of the information you provide. Formula for calculating net salary.

The Canada Monthly Tax Calculator is updated for the 202122 tax year. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. You assume the risks associated with using this calculator.

Where NI 151978 BPAF 13808. Use the simple weekly Canada tax calculator or switch to the advanced Canada weekly tax calculator to review NIS. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

We applied relevant deductions and exemptions before calculating income tax withholding. Monthly taxes 25. That means that your net pay will be 40568 per year or 3381 per month.

Enter annual salary and average monthly commission. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. Annual salary without commas average weekly hours average monthly commission without commas Take one of the two calculated amounts from the boxes on the right.

Semi-monthly paycheck purchasing power unemployment rate and income growth. Net annual salary Weeks of work year Net weekly income. For 2021 employers can use a BPAF of 13808 for all employees while payroll systems and procedures are updated to fully implement the proposed legislation.

We also created an RRSP calculator which shows you how much tax refund can you expect after your contributions. Methodology To find the most paycheck friendly places for counties across the country we considered four factors. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary.

The amount can be hourly daily weekly monthly or even annual earnings. If you have income from sources other than employment we suggest you to use our tax calculator to estimate how much taxes you have to pay after. Youll then get a breakdown of your total tax liability and take-home pay.

First we calculated the semi-monthly paycheck for a single individual with two personal allowances. The Canada Weekly Tax Calculator is updated for the 202122 tax year. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions.

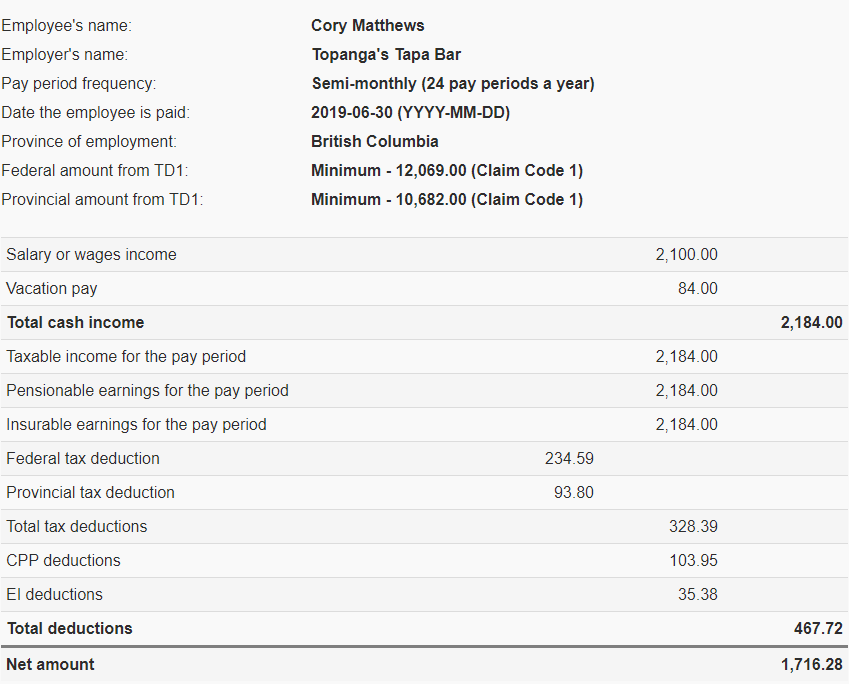

After you complete calculations for your employees you can also view print and save a summary of your employer remittance amounts from a separate page. Your average tax rate is 220 and your marginal tax rate is 353. In addition to simplifying payroll the payroll calculator helps you know how much you owe the CRA at the end of each month.

This is required information only if you selected the hourly salary option. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. Hourly Pay Rate.

To better compare withholding across counties we assumed a 50000 annual income. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. Salary Before Tax your total earnings before any taxes have been deducted.

Also known as Gross Income. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

The calculator is updated with the tax rates of all Canadian provinces and territories. Select the province. Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box.

Mortgage Tips And Tricks How A Mortgage Calculator Can Save You Bundles Of Dave Ramsey Mortgage Mortgage Payoff Pay Off Mortgage Early

Account Suspended Monthly Budget Spreadsheet Monthly Budget Budget Spreadsheet

Personal Business Loans Webmasters Amortization Calculator Will Bring Sale Amortization Schedule Mortgage Amortization Calculator Mortgage Amortization

How To Negotiate Your Debt With Collectors Deudas Making Ideas Dinero

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Home Affordability Calculator For Excel

Calculate If That New Job Is Right For You Knowledge Bureau

If He Or She Passes Away Within The Term Of The Policy The Life Insurance Coverage Business Will Pay The Recipien Budgeting Money Budgeting Budgeting Finances

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

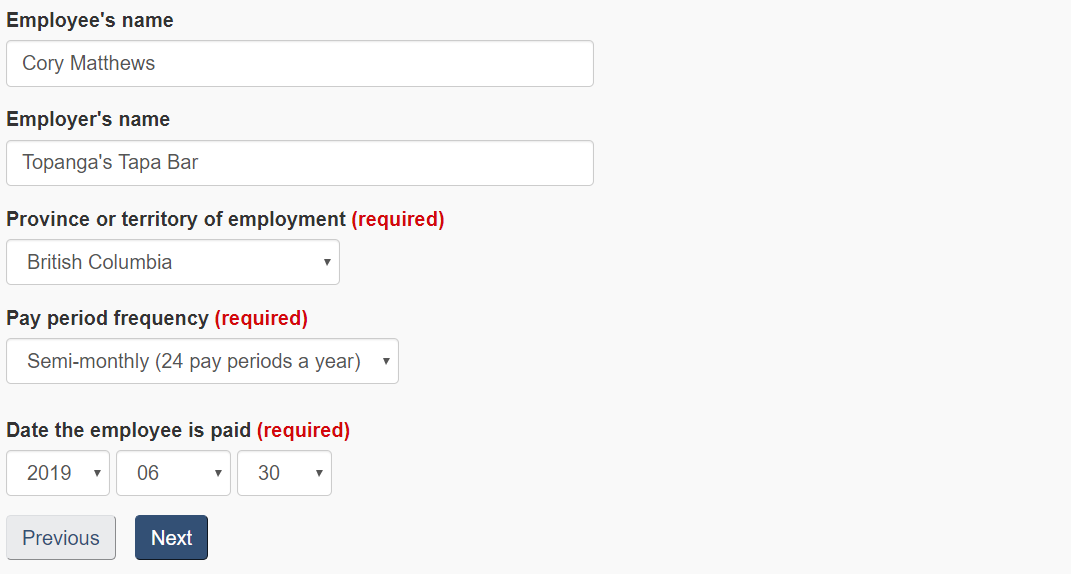

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

How To Calculate Your Monthly Car Payments

Editable Blank Check Template Unique New Payroll Template Free Konoplja Co In 2020 Payroll Template Templates Printable Checks

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Calculate If That New Job Is Right For You Knowledge Bureau

This Credit Card Calculator Will Calculate Your Minimum Monthly Payment Given A Credit Card Balance An Paying Off Credit Cards Credit Card Balance Credit Card

Hehehehehe Boodle Moneytalks Money Doesnt Buy Happiness Managing Your Money Bring Happiness

31 Days Zero Credit Card Debt Eat Pray Read Love Credit Card Payoff Plan Paying Off Credit Cards Balance Transfer Credit Cards

Post a Comment for "Monthly Paycheck Calculator Ontario"