Monthly Salary Calculator Uk

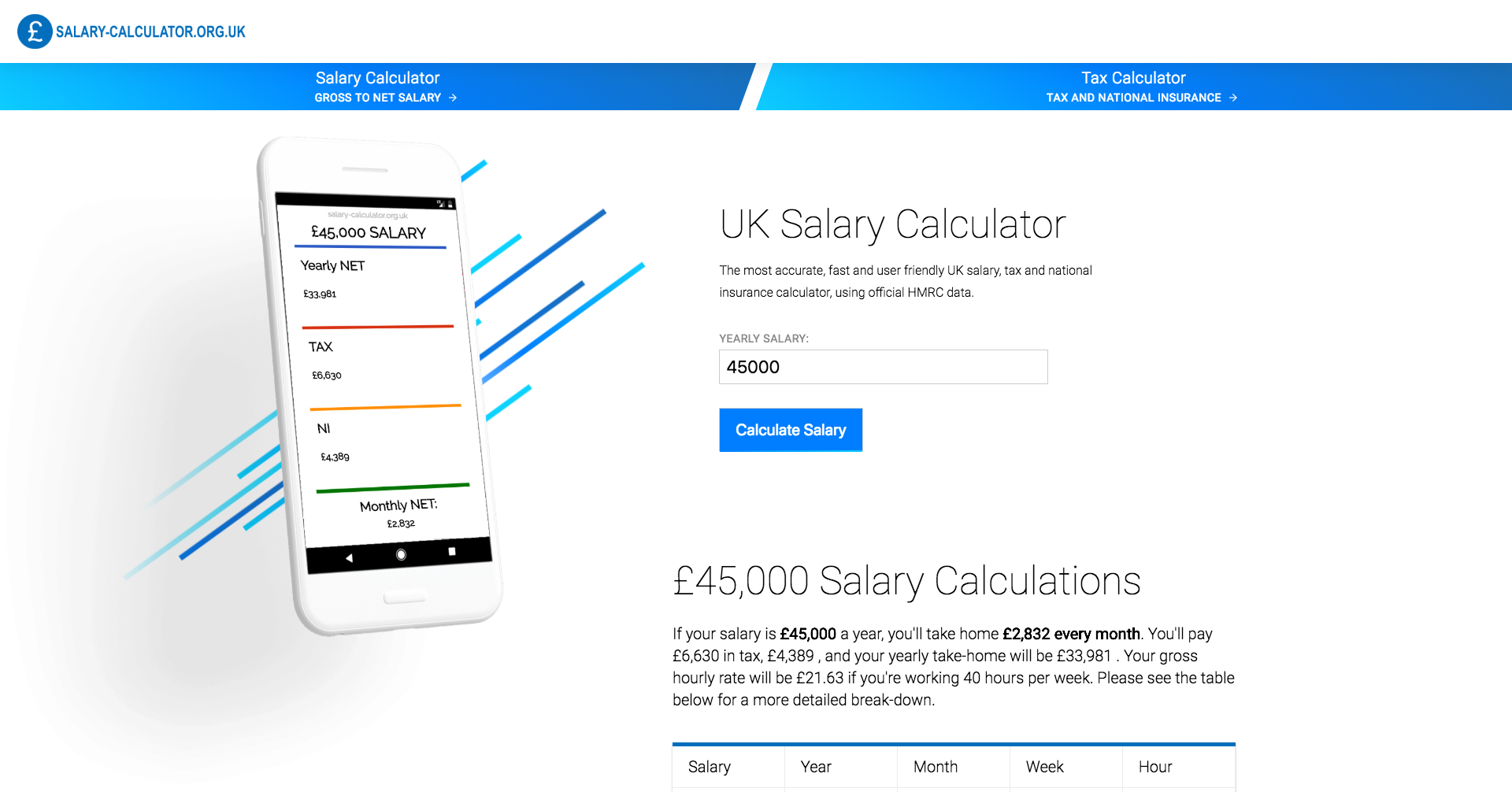

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. What is the Average UK Income.

Uk Income Tax Calculator August 2021 Incomeaftertax Com

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features.

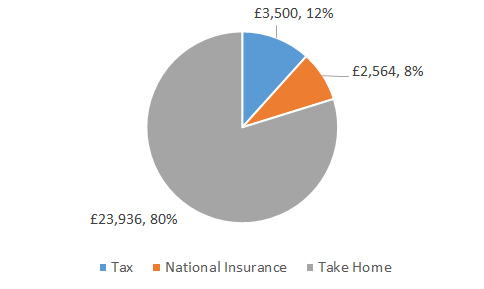

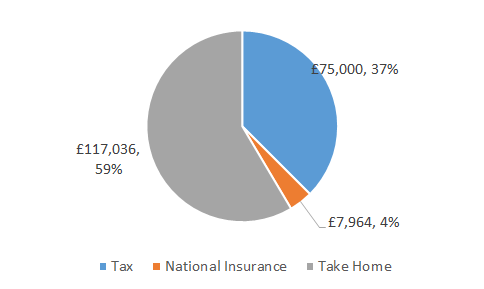

Monthly salary calculator uk. Use the take-home pay calculator to get your monthly or annual net salary after normal UK tax and National Insurance contributions. Youll then get a breakdown of your total tax liability and take-home pay. See how much of a difference that pay rise would make or calculate your net income in the UK.

Calculate your take home salary weekly monthly and annually using the salary calculator UK. This article was published on 7 Oct 2020. Find out your take-home pay - MSE.

The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. ICalculator Monthly salary sacrifice calculator is updated for the 202122 tax year. Use the simple monthly salary sacrifice calculator or switch to the advanced monthly salary sacrifice calculator to review employers national insurance payments income tax.

Also known as Gross Income. The results are broken down into yearly monthly weekly daily and hourly wages. Check your payroll calculations manually - GOVUK.

UK Tax Salary Calculator. Youre paying a worker the National Living Wage. Half of the population earns less than this figure and.

If you have benefits in kind you can enter two different BIK value sot compare the differences too. Youre paying a worker the National Minimum Wage. Accurate fast and user friendly UK salary calculator using official HMRC data.

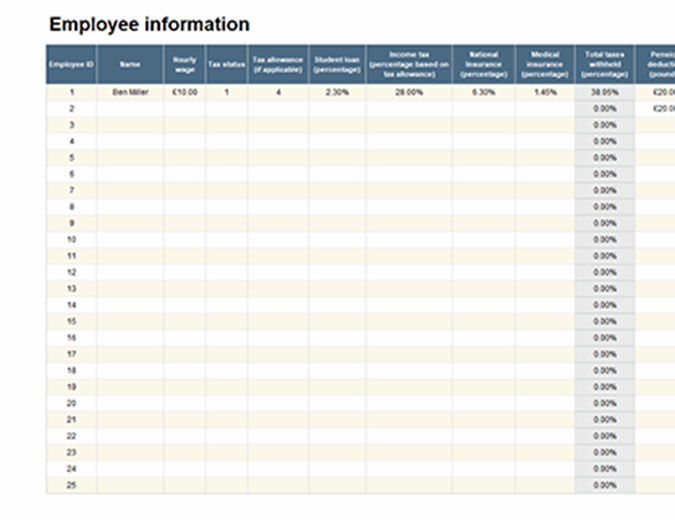

This is very useful is you are wondering what the difference a pay rise will make - or comparing salaries from two jobs. Our salary calculator will provide you with an illustration of the costs associated with each employee. If you are based outside the UK you should contact the Direct Tax Team for more information on your take home pay as you may be subject to overseas tax regulations.

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Total Combined Monthly Salary. You can also optionally enter a second gross salary to compare against the first.

Calculations for tax are based on a tax code of S1250L. You can calculate your Monthly take home pay based of your Monthly gross income salary sacrifice adjustment PAYE NI and tax for 202122. National Minimum Wage and Living Wage calculator for employers.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual.

Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. 851667 Total Combine Annual Salary.

Salary Before Tax your total earnings before any taxes have been deducted. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. This is because should a tax code change for any reason it will. We strongly recommend you agree to a gross salary rather than a net salary.

Net Salary Calculator 2020 10855 KB Excel Please note. An easy to use yet advanced salary calculator at your fingertips. You owe your.

Results include unadjusted figures and adjusted figures that account for vacation days and holidays per year. Just enter your salary. The Monthly Salary Calculator is updated with the latest income tax rates in United Kingdom for 2021 and is a great calculator for working out your income tax and salary after tax based on Monthly income.

The results are broken down into yearly monthly weekly daily and hourly wages. Simply type in what you earn annually and our salary calculator will work out your take-home pay your personal allowance. The calculator is designed to be used online with mobile desktop and tablet devices.

Examples of payment frequencies include biweekly semi-monthly or monthly payments. Calculate your monthly net pay based on your yearly gross income with our salary calculator. You will see the costs to you as an employer including tax NI and pension contributions.

We offer you the chance to provide a gross or net salary for your calculations.

How Is Tax Calculated Explained Example Rates Simplified 2018 Calculator

25 000 After Tax Salary Calculator Uk

The Salary Calculator Pro Rata Tax Calculator

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

50 000 After Tax 2021 Income Tax Uk

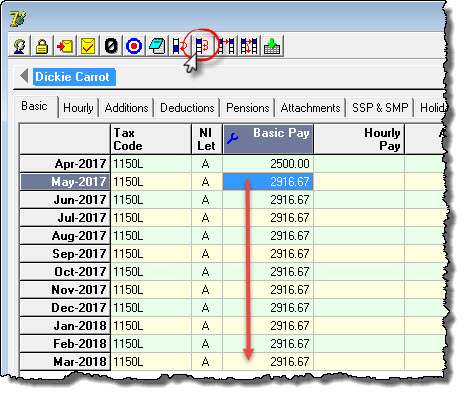

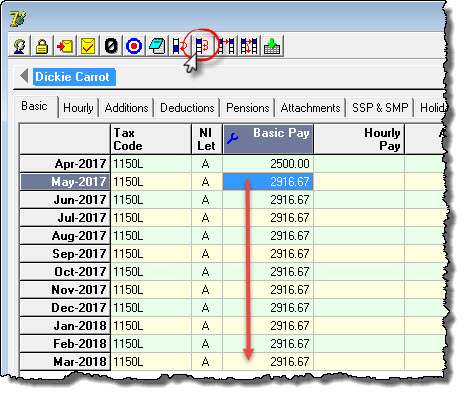

Changing The Annual Salary Of An Employee Moneysoft

Career Lesson Wage Conversion Chart Hourly Pay Is Converted To Monthly And Yearly Pay To Help Kids Calculate Their I Career Lessons Conversion Chart Lesson

How To Calculate Your Take Home Salary A Uk Guide

Pro Rata Salary Calculator Uk Tax Calculators

Comparison Of Uk And Usa Take Home The Salary Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Comparison Of Uk And Usa Take Home The Salary Calculator

Salary Calculator Isgoodsalary

Post a Comment for "Monthly Salary Calculator Uk"