Monthly Salary Calculator Illinois

How is Alimony Calculated in Illinois. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Illinois Salary Paycheck Calculator Paycheckcity

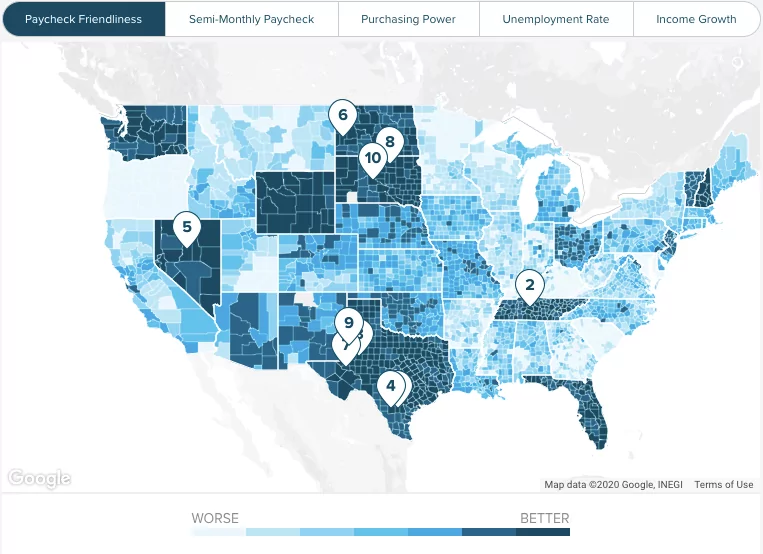

You can see how your job and your salary will be impacted by a change of location.

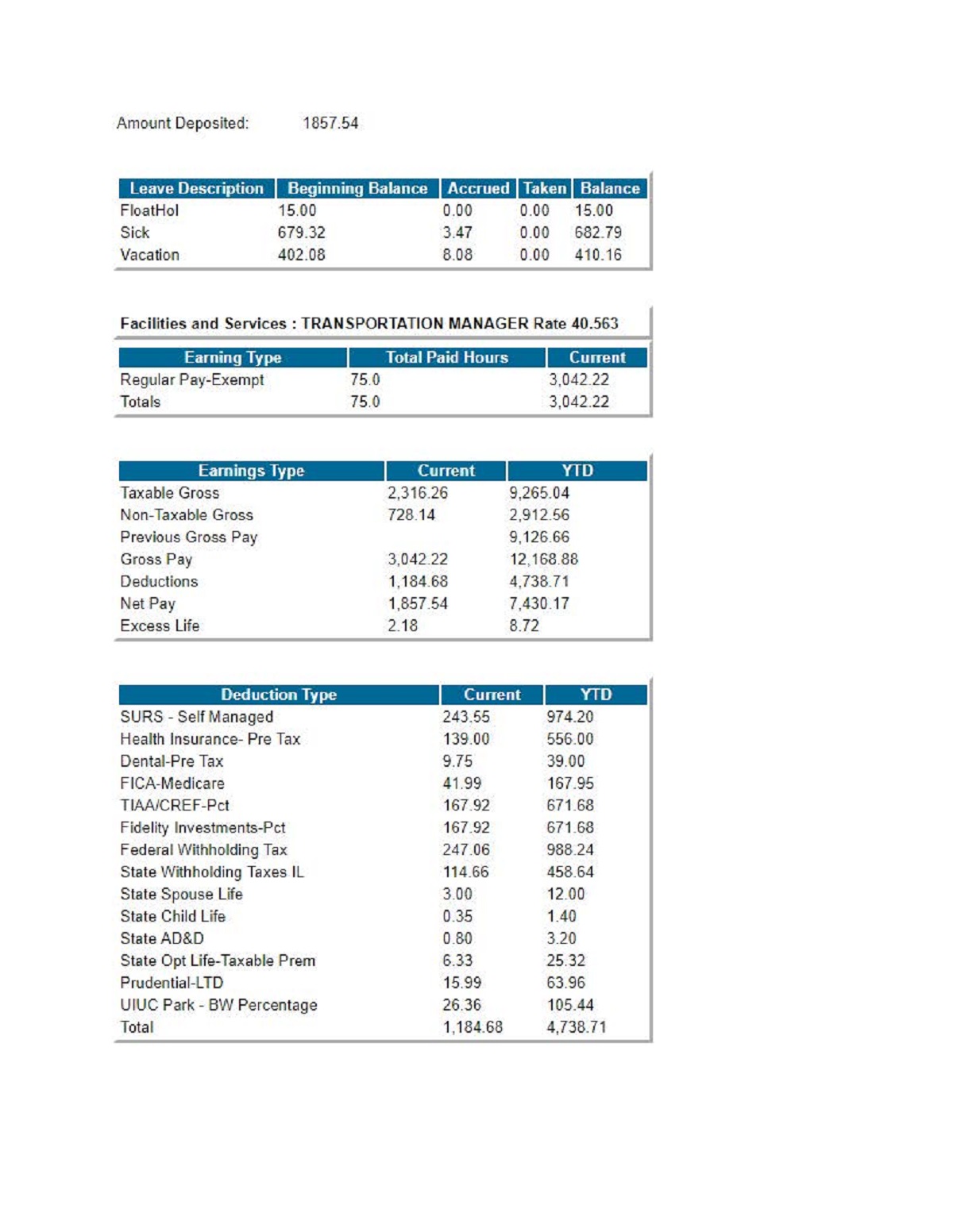

Monthly salary calculator illinois. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year they will receive three paychecks. The results are broken up into three sections.

Hourly rates weekly pay and bonuses are also catered for. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On. Detailed salary after tax calculation including Illinois State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Illinois state tax tables.

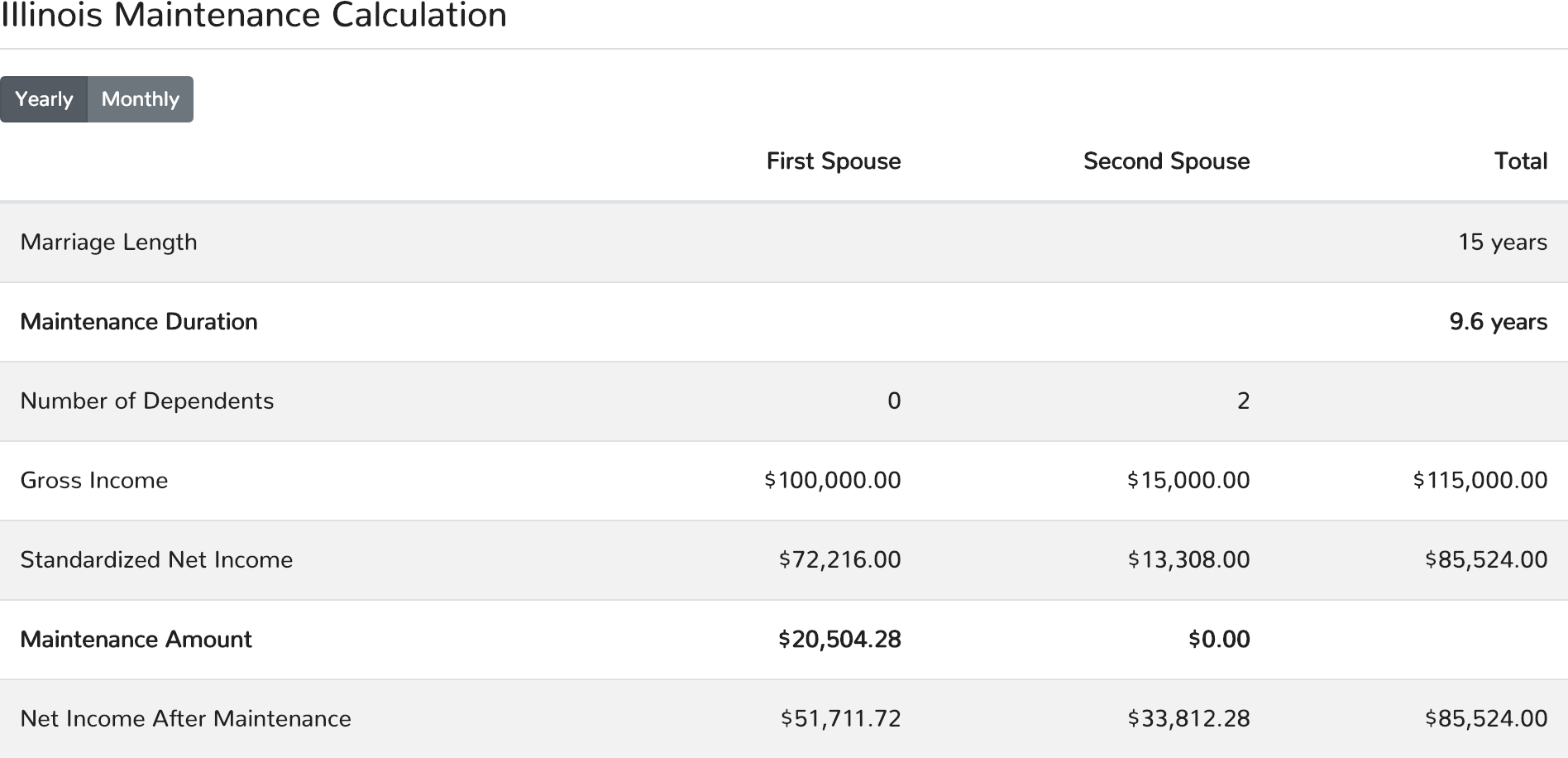

In 2019 this formula is used to calculate alimony in Illinois. The adjusted annual salary can be calculated as. Why not find your dream salary too.

The table below details how Illinois State Income Tax is calculated in 2021. So if you earn 10440 per hour your annual salary is 19000000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours per week and your monthly salary is 1583333. One of a suite of free online calculators provided by the team at iCalculator.

The latest budget information from April 2021 is used to show you exactly what you need to know. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If you live in one location but work in another the. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. 33 of the payers net income 25 of the payees net income the yearly maintenance paid.

Illinois State Tax Calculation for 9000000 Salary. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. Illinois Salary Paycheck Calculator Results Below are your Illinois salary paycheck results.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

Illinois Hourly Paycheck Calculator. All bi-weekly semi-monthly monthly and quarterly figures. Also a bi-weekly payment frequency generates two more paychecks a year 26 compared to 24 for semi-monthly.

These hours are equivalent to working an 8-hour day. For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month.

Salaries in Illinois range from 28000 USD per year minimum salary to 494000 USD per year maximum average salary actual maximum is higher. 3000000 salary example for employee and employer paying Illinois State tincome taxes. However that spousal support cannot cause one spouse to earn more than 40 of the couples combined income.

See how we can help. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The Income Tax calculation for Illinois includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Illinois State Tax Tables in 2021.

The Illinois Salary Calculator allows you to quickly calculate your salary after tax including Illinois State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Illinois state tax tables. Median Salary The median salary is 117000 USD per year which means that half 50 of the population are earning less than 117000 USD while the other half are earning more than 117000 USD. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois.

The following table shows the equivalent pre-tax hourly income associated with various monthly salaries for a person who worked 8 hours a day for either 200 or 250 days for a total of 1600 to 2000 hours per year. Illinois Salary Paycheck Calculator. This Illinois hourly paycheck calculator is perfect for those who.

One of a suite of free online calculators provided by the team at iCalculator. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is. One of a suite of free online calculators provided by the team at iCalculator.

The Illinois Salary Comparison Calculator allows you to quickly calculate and compare upto 6 salaries in Illinois or compare with other states for the 2021 tax year and historical tax years.

Paycheck Calculator Take Home Pay Calculator

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

New Tax Law Take Home Pay Calculator For 75 000 Salary

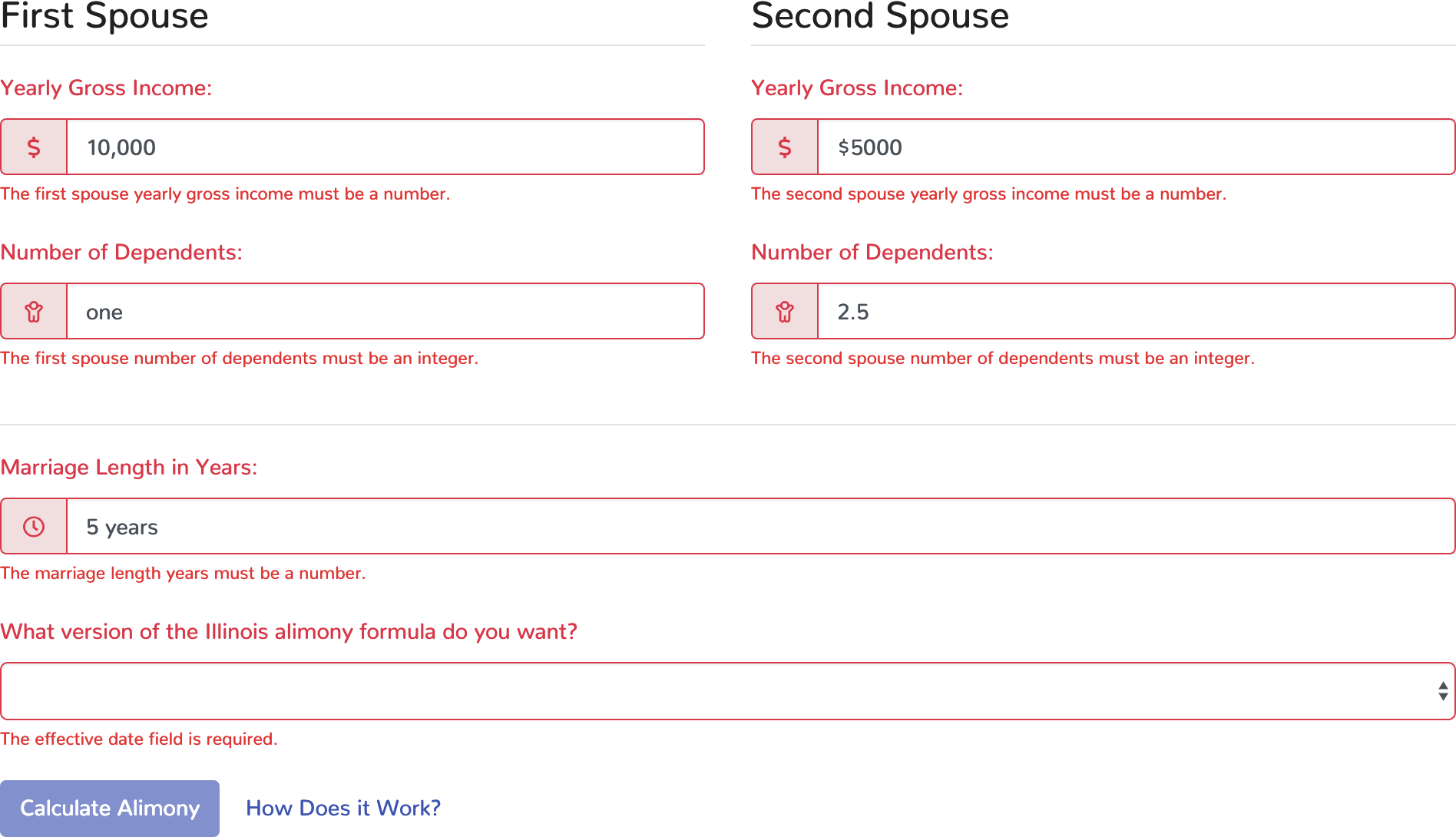

Calculating Illinois Maintenance Legal Calculators

Paycheck Calculator Salaried Employees Primepay

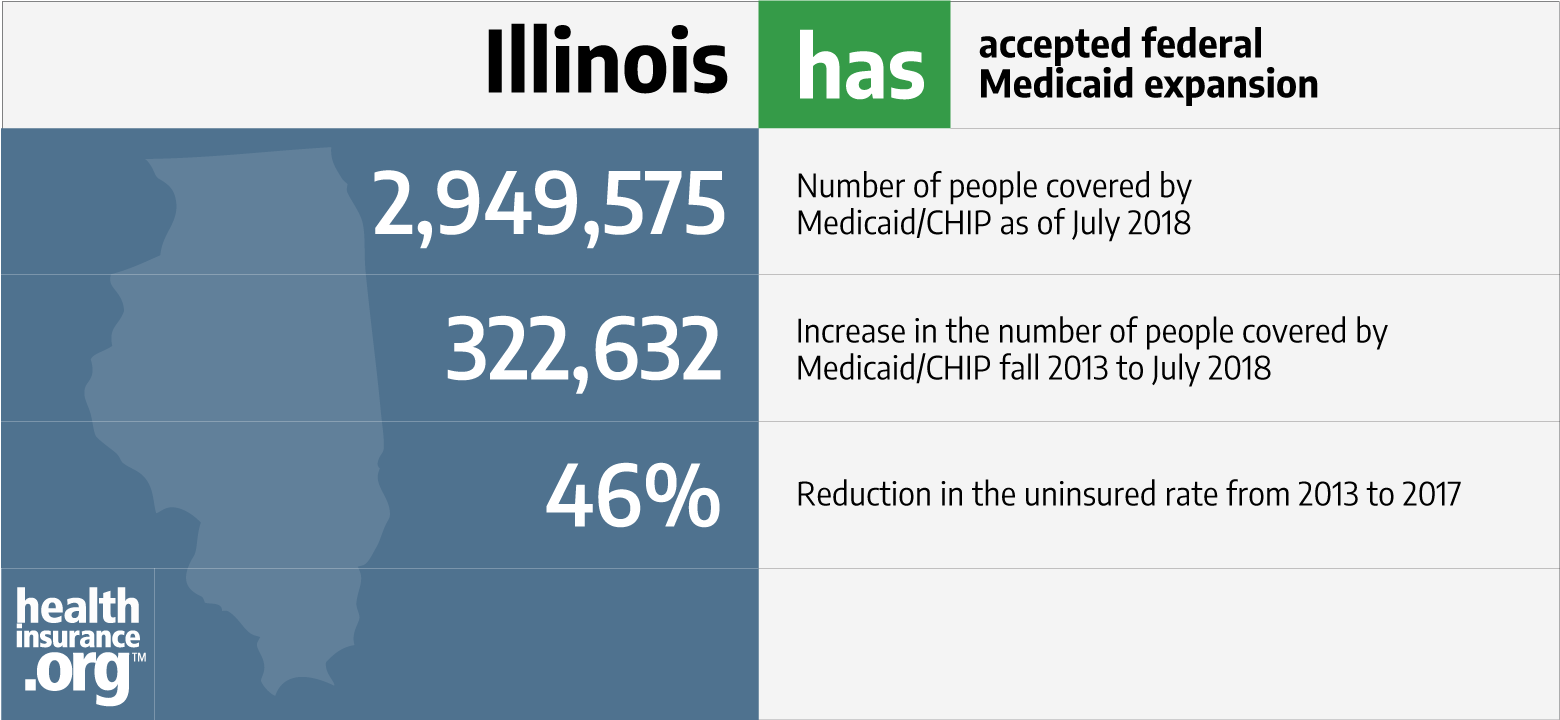

Illinois And The Aca S Medicaid Expansion Healthinsurance Org

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Illinois Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Understanding Your Pay Statement Office Of Human Resources

Calculating Illinois Maintenance Legal Calculators

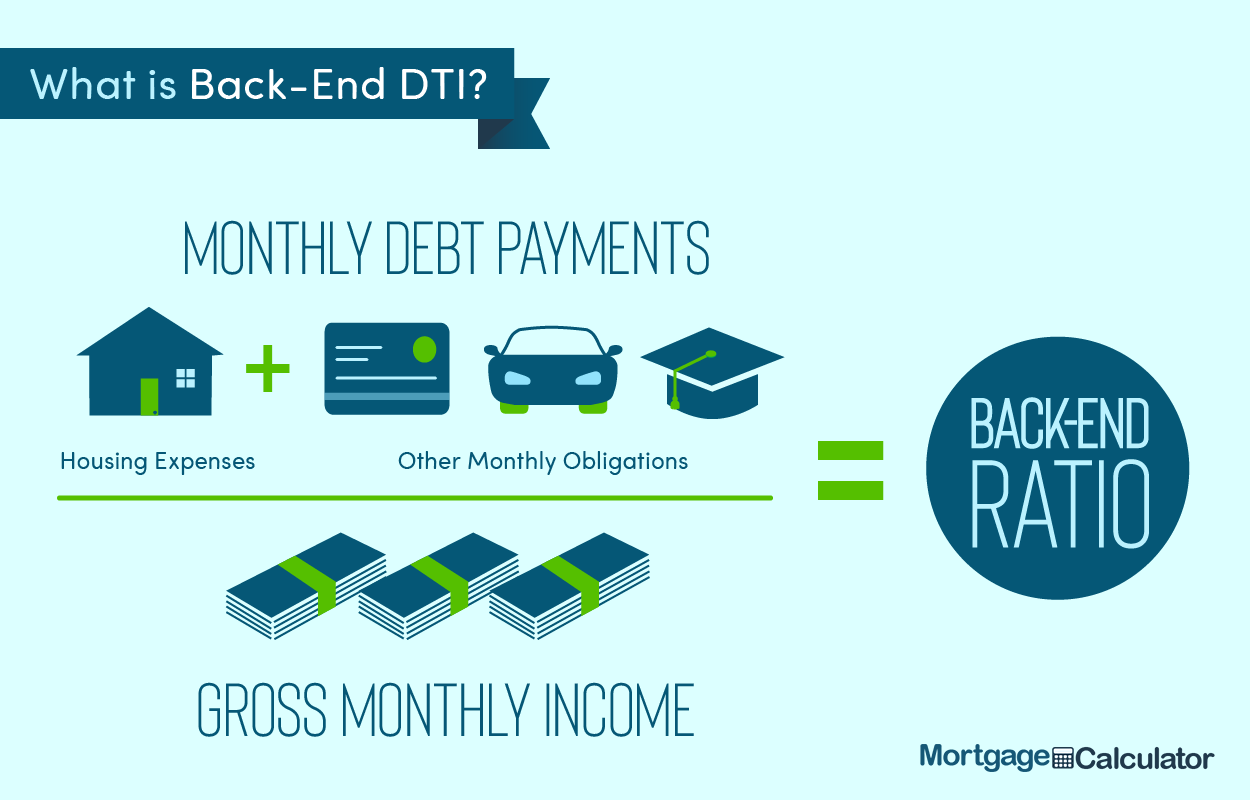

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Oregon Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2021

5 Free Salary Calculator Websites With State Tax Calculations

Post a Comment for "Monthly Salary Calculator Illinois"