Gross Pay What Does Mean

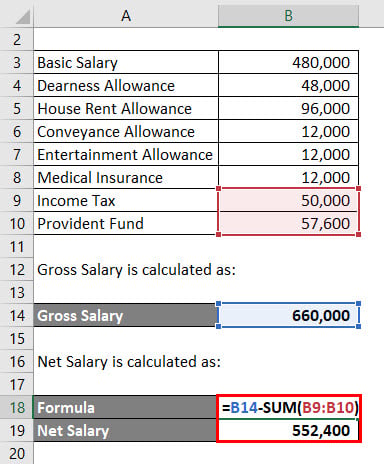

Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee. Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax.

Earnings Statistics Statistics Explained

For example when an employer pays you an annual salary of 40000 per year this means you have earned 40000 in gross pay.

Gross pay what does mean. The exempt or salaried employee is paid gross pay based on the amount of her annual salary divided by the. Your net pay is what you get after taxes insurance 401 k union dues etc are deducted. Deductions such as mandated taxes and Medicare contributions as well as deductions made for company health insurance or retirement funds are not accounted for when gross pay is calculated.

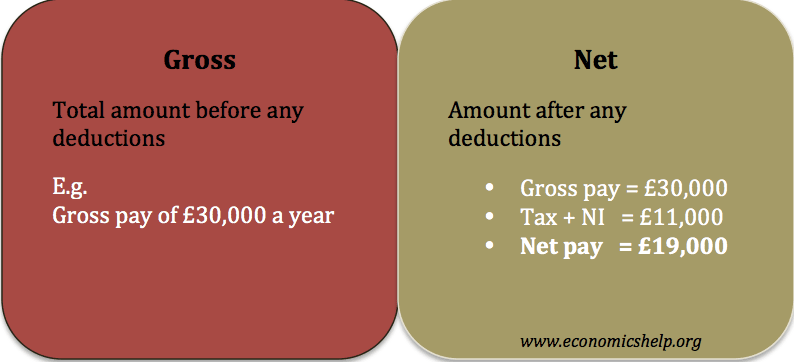

Gross pay is almost exclusively higher than Net Pay Net Pay is the amount you receive after all deductions have been made. While your net pay is the actual amount of your paycheck your gross pay includes money that you never see though the missing amount shows up as various types of deductions from your pay. It is the total amount of remuneration before removing taxes and other deductions such as Medicare social security insurance and contributions to pension and charity.

It does not include any allowances overtime or any extra compensation. We will use an annual Retail Sales Worker salary for our examples. This is the amount of money that will go into your bank account or on the cheque or paid in cash to you to spend.

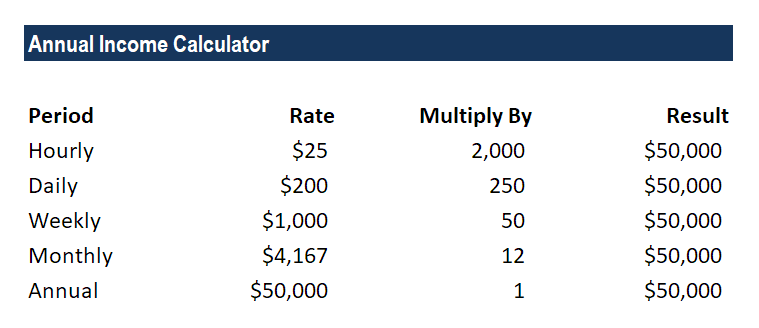

Gross pay is an individuals total earnings throughout a given period before any deductions are made. For example if the employees gross pay is 50000 for a year with a monthly pay schedule then 5000012 is the gross wage for every pay period. Wiktionary 000 0 votesRate this definition.

This is the amount of money that will go into your bank account or on the cheque or paid in cash to you to spend. Thus The numbers below are presented gross of. Gross pay Noun A payment for the entire years income.

Net pay is the total amount of money that the employer pays in a paycheck to an employee after all required and. It includes the full amount of pay before any taxes or deductions. This is total gross pay less all the deductions both statutory and voluntary.

What does gross pay meanA spoken definition of gross payIntro SoundTypewriter - TamskpLicensed under CCBA 30Outro MusicGroove Groove - Kevin MacLeod i. It includes tax and National Insurance. Notice I didnt say it was the total amount paid to each employee.

Gross pay is the amount of money an employee earns for time they worked. Gross payroll stems from gross wages so to figure the former you must determine the latter. Your pay net taxes is what you get after taxes are deducted.

Gross pay Noun An amount of pay wages salary or other compensation before deductions such as for taxes insurance. Your gross pay is your rate multiplied by hours plus bonuses etc. Gross pay on a pay stub is the total wages an employee usually earns before payroll taxes and other deductions are taken out.

Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay. An employees gross pay is simply her compensation before deductions but things arent always so. Defining Gross Pay.

Gross pay is the amount that you are actually paid by a company. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. Gross Pay is the amount your earn before any deductions are made.

Basic salary is the amount paid to an employee before any extras are added or taken off. An employees gross pay is the amount of wages before any deductions including taxes and benefits. Gross rate of pay is your basic rate of pay plus allowances.

Understanding Gross Pay and Net Pay Gross Pay. Gross pay this is your full pay before any tax or National Insurance has been taken off including any bonuses and commission. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

Gross pay often called gross wages is the total compensation earned by each employee. Variable deductions this refers to the deductions that could change each payday and will show the amount thats being paid. Gross pay may be determined by the amount an employee works as in hourly.

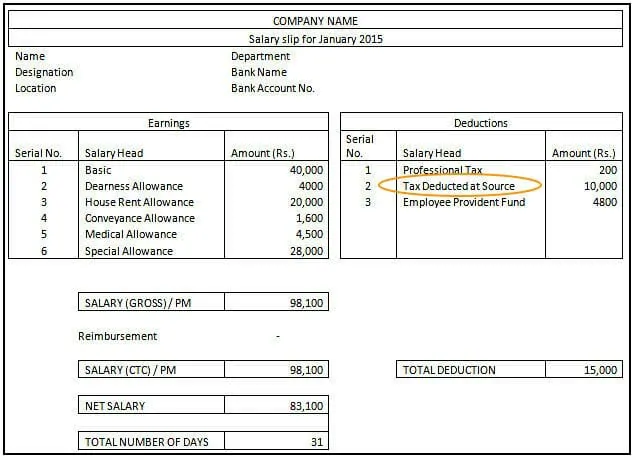

Salary Slips In 2021 How Do They Work Samples Tax Deductions Components Scripbox

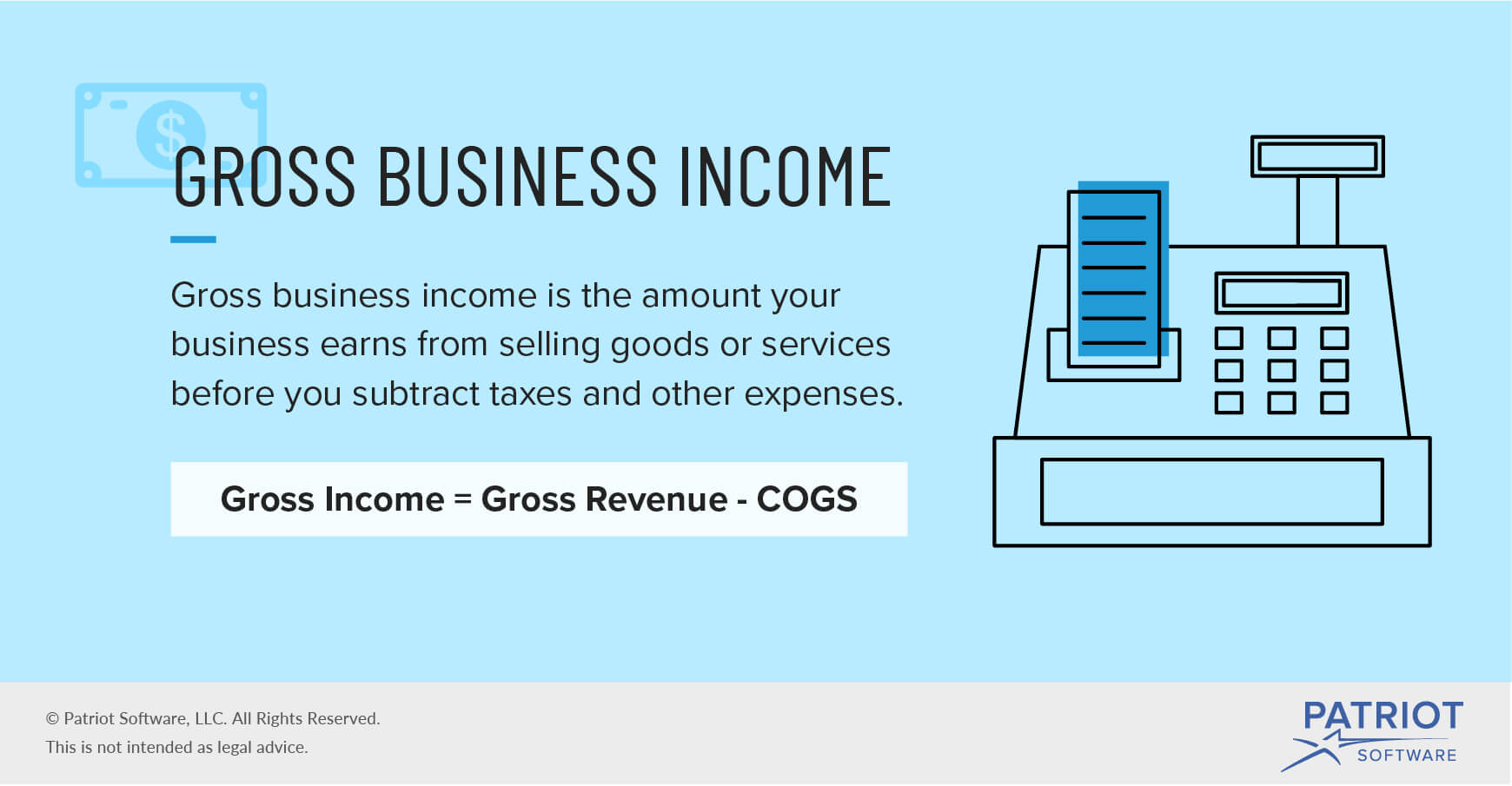

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

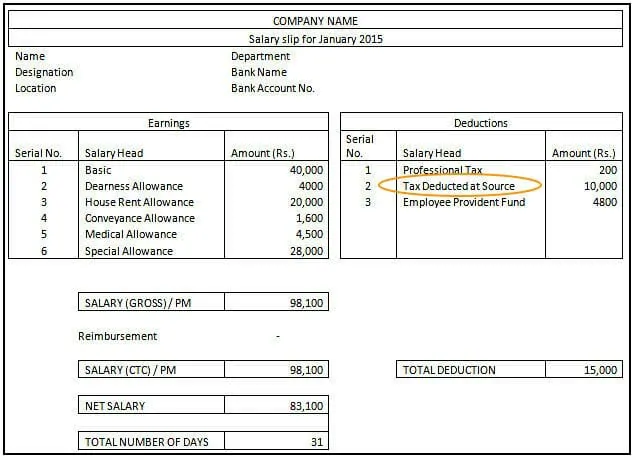

What Are Gross Wages Definition And Overview

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How Are Cycle To Work Savings Made Cyclescheme Knowledge Base

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Operating Income Vs Gross Profit

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

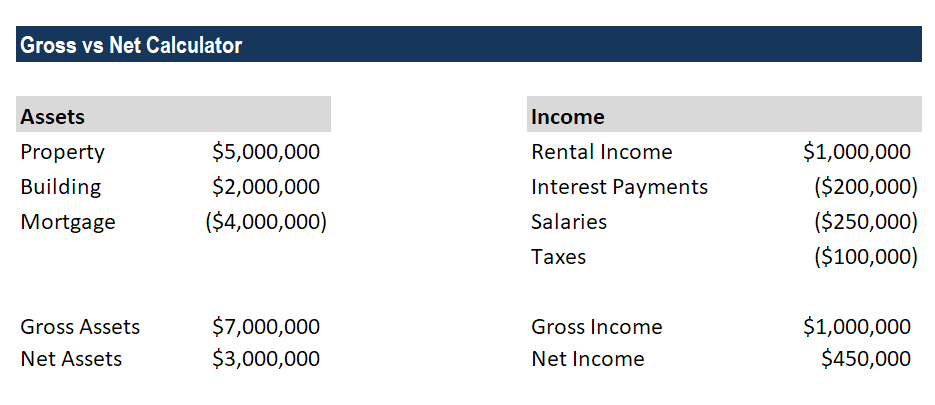

Gross Vs Net Learn The Difference Between Gross Vs Net

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Annual Income Learn How To Calculate Total Annual Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

The Difference Between Gross And Net Pay Economics Help

Gross Vs Net Learn The Difference Between Gross Vs Net

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Income For A Business

Gross Income Definition Formula Examples

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "Gross Pay What Does Mean"