13th Month Pay Exempt From Tax

The 13 th month pay is exempt from tax up to a limit of PHP 82000 US1600. However any payments over the one-twelfth denomination of the employees basic salary are taxable.

A Guide To 13th Month Pay Goglobal

The 13th month pay is exempt from tax up to a limit of PHP 82000 US1600.

13th month pay exempt from tax. The salary cap of 13th month pay tax exemption is set to 90000 under the TRAIN Law. So if are receiving a monthly salary worth 120000 it is expected that youll have a 13th month pay worth 120000. We are not exempting anybody from paying 13th month pay said Bello.

The amendment was introduced during a bicameral conference committee meeting to reconcile the Senate and House of Representatives versions of tax reform before President Rodrigo Duterte can sign it into law. Private sector workers get a mandatory 13th-month pay. Pinagaaralan namin ngayong kung doable We are studying if it is doable Speaker Pantaleon Alvarez said.

For example the exclusion rate in the Philippines is P90000the maximum amount allowed without taxation. Before RA 10653 was signed into law in February of 2015 only bonuses not exceeding P30000 were exempted from tax. Especially those with total bonuses including 13th-month pay of over PHP 82000 can have more money to spend and save during the Christmas holidays.

The 13th month pay is generally exempt from taxation. This means that if the total value of the 13th Month Pay benefit combined with any other allowances or benefits received by an employee during the year does not exceed 90000 such benefitsallowances will be exempt from income tax. MANILA - Lawmakers agreed to raise the cap on tax exempted 13th month pay to P90000 a Senate leader said Thursday.

The current administration wants to take away the tax exemption on the mandatory additional one-month salary bonuses and incentives. More than that it is taxable. The DOF is seeking the repeal of provisions of the Tax.

Is 13th month pay taxable under train law. Dax Cua chairman of the House Ways and Means Committee. However there is a prescribed limit to this exemption provided under Section 32 B 7 e of the National Internal Revenue Code NIRC which was amended by Republic Act No.

Apart from this many of them are given Christmas bonus. Higher Tax Exemption Cap for 13th Month Pay From PHP 82000 the tax exemption ceiling for 13th-month pay and other bonuses is now at PHP 90000. The tax on the 13th month pay however would still be smaller compared to the total tax exemptions of those earning under P250000 annually said Quirino Rep.

However in January 2018 the government issued the Tax Reform for Acceleration and Inclusion TRAIN law which raised this limit to PHP 90000 US1778. However there is a prescribed limit to this exemption provided under Section 32 B 7 e of the National Internal Revenue Code NIRC which was amended by Republic Act No. However he clarified that the implementing rules and regulations IRR of.

The current administration wants to take away the tax exemption on the mandatory additional one-month salary. However in January 2018 the government issued the Tax Reform for Acceleration. However in January 2018 the government issued the Tax Reform for Acceleration and Inclusion TRAIN law which raised this limit to PHP 90000 US1778.

10963 or the TRAIN law on January 2018. According to Presidential Decree PD 851 as amended also known as the 13th-Month Pay Law all employers are required to pay all their rank-and-file employees a 13th-month pay not later than December 24 of every year Section 1 Ibid. The 13th month pay is exempt from tax up to a limit of PHP 82000 US1600.

With regards to the specific tax per amount to be implemented on the year-end pay-out that goes higher than Php 9000000 it was not specified in the primer. 10963 or the TRAIN law on January 2018. More than that it is taxable.

Based on the primer if your 13th month pay is Php 9000000 and below it is not subject for tax deduction. Meanwhile government personnel receive a mid-year bonus equivalent to one-month salary and a year-end productivity incentive aside from the 13th-month pay. The 13th month pay is generally exempt from taxation.

The excess amount however of the de minimis benefits can be included as part of the P82000 ceiling and will be exempt as long as the total 13th month pay bonuses and other benefits do. It is the current exemption cap after it was raised from Php 8200000. Pursuant to Republic Act 10653 the 13th month pay and other benefits including productivity incentives and Christmas bonuses not exceeding P82000 provided to both government and private sector employees are exempted from tax.

13th-month pay is usually exempt from any taxes.

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

How To Compute Your 13th Month Pay 2020 Jobs360

How Will Train Impact You Cloudcfo

13th Month Pay Law Employee Benefits Piece Work

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

A 13th Month Pay Guide For Employees

Tax Calculator Compute Your New Income Tax

Tax Exemptions And De Minimis Benefits

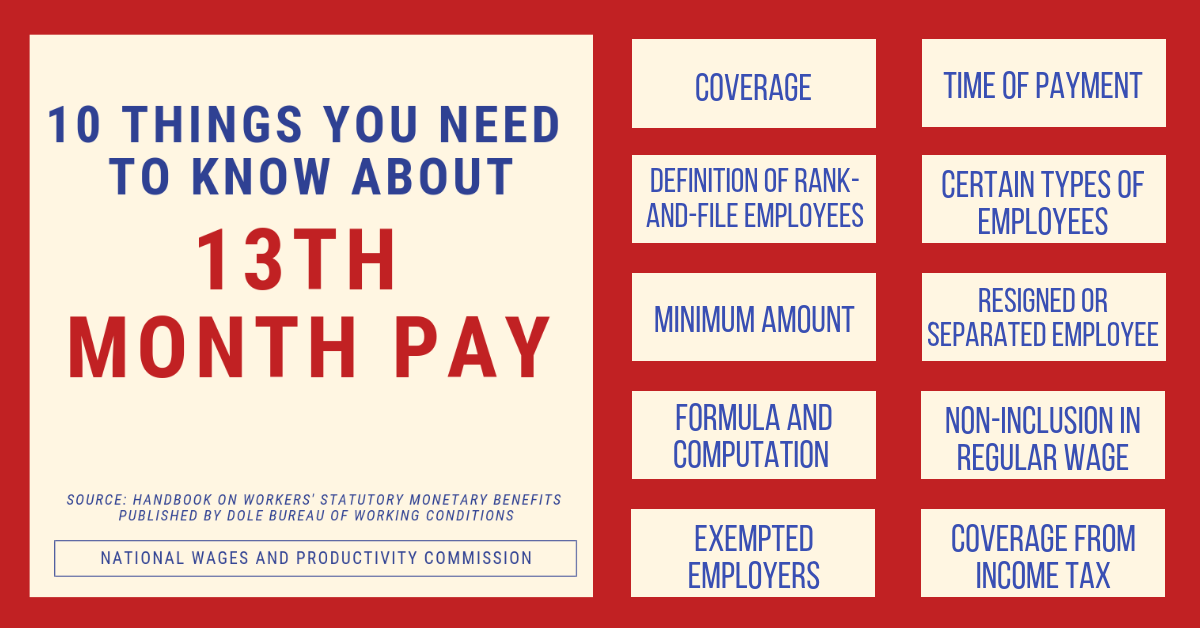

10 Things You Need To Know About 13th Month Pay Deped Teachers Club

13th Month Pay An Employer S Guide To Monetary Benefits

How To Compute For 13th Month Pay In The Philippines Coins Ph

Dole Guidelines For 13th Month Pay In Private Sectors

Increase In The Ceiling Of 13th Month Pay And Other Benefits Memoentry

10 Things You Need To Know About 13th Month Pay Dole

13th Month Pay An Employer S Guide To Monetary Benefits

How To Compute Your 13th Month Pay 2020 Jobs360

Philippines Understanding Taxation Of 13th Month Pay And Christmas Bonuses In The Philippines Asean Economic Community Strategy Center

Post a Comment for "13th Month Pay Exempt From Tax"